After making significant advancements in recent years, Artificial Intelligence (AI) is poised to become one of the most transformative technologies in modern society. The market for artificial intelligence (AI) is expected to show strong growth in the coming decade. Its value of nearly 100 billion U.S. dollars is expected to grow twentyfold by 2030, up to nearly two trillion U.S. dollars. AI-powered systems are already changing the way we live and work, from personal assistants to self-driving cars. However, many people still wonder about the fundamentals of AI and how it works. In this series of articles, we will delve into the basics of AI, including its history, milestones, and various applications across industries. Specifically, we will explore the significant impact of AI on the finance industry, which is experiencing a paradigm shift due to this rapidly advancing technology. Along the way, we will examine both the potential benefits and risks of AI and what the future may hold for this groundbreaking field.

Fundamentals of AI

AI stands for Artificial Intelligence. It is a branch of computer science that deals with creating intelligent machines that can perform tasks that normally require human intelligence, such as learning, problem-solving, decision-making, and perception.

AI is achieved by creating algorithms and computer programs that can process and analyze large amounts of data, learn from patterns and trends, and make predictions and decisions based on that data. These algorithms can be trained to improve their performance over time and can even teach themselves new skills and abilities through a process called Machine Learning

Evolution of Artificial Intelligence

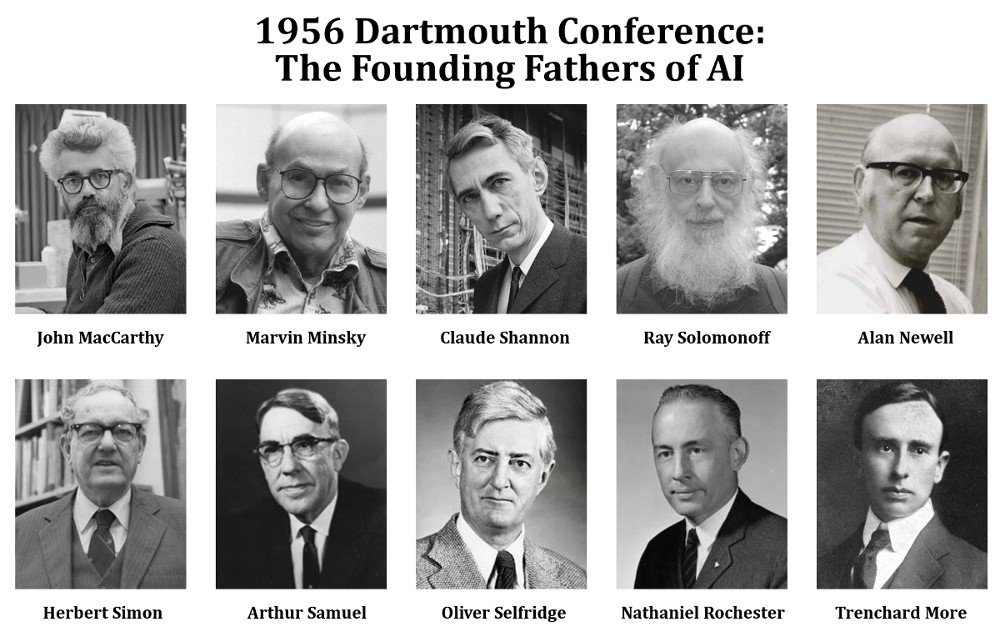

The development of AI has been a long and ongoing process, with several key milestones along the way. The Dartmouth Conference (1956): is considered the birthplace of AI. A group of researchers gathered at Dartmouth College to discuss the potential of creating intelligent machines that could mimic human intelligence. Alan Turing proposed a test (The Turing Test -1950) to determine whether a machine can exhibit intelligent behavior equivalent to, or indistinguishable from, that of a human. This test remains a standard benchmark for AI research to this day.

During the 1970s and 1980s, Expert systems were designed to emulate the decision-making ability of a human expert in a specific domain. They were used in various applications such as medical diagnosis, financial analysis, and oil exploration. Machine learning algorithms were developed in the 80s and 90s to allow machines to learn from data, improving their performance over time. This led to the development of various techniques such as neural networks, decision trees, and support vector machines.

Deep learning is a very critical milestone of AI technology in the 2010s, which is a subset of machine learning that uses neural networks with many layers to improve the accuracy of predictions and decision-making. Deep learning has led to breakthroughs in applications such as image recognition, speech recognition, and natural language processing.

AI innovations have had a significant impact on our daily lives, with numerous successful examples to showcase. Some notable ones include Apple’s Siri (2012), AlphaGo (2016), Deepfake (2017), OpenAI GPT (2018), Google Duplex (2018), DeepMind’s AlphaFold (2020), GPT-3 (2020), and the more recent mid-journey (2022).

These milestones and innovations demonstrate the continued evolution and impact of AI on various industries, including healthcare, language processing, and research. As AI continues to advance, it has the potential to transform how we live and work in ways we cannot yet imagine.

Decision-making process

All the subsequent mechanical or physical application steps in an AI-based or supported system rely on AI decision-making. The process of AI decision-making can be highly complex and technical, and it may be beyond the scope of this article. However, in general, the development and deployment of effective AI decision-making systems require specialized skills, expertise, and resources, making it a challenging but rewarding endeavor. The process of an AI decision typically involves the following steps:

Data Collection: AI systems require large amounts of data to make informed decisions. The first step in the decision-making process is to collect relevant data from various sources.

Data Preprocessing: Once the data is collected, it needs to be cleaned, organized, and transformed into a suitable format that can be used by the AI system.

Feature Extraction: In this step, the relevant features of the data are identified and extracted to create a set of input variables that can be used by the AI model.

Model Training: The AI model is trained using the preprocessed data and input variables to learn the underlying patterns and relationships in the data.

Model Evaluation: After the model is trained, it is evaluated to ensure that it performs accurately and efficiently on new data.

Decision Making: Once the model is trained and evaluated, it can be used to make decisions based on new input data. The AI system processes the input data, applies the learned patterns and relationships, and generates a decision or prediction.

Refinement: The AI decision-making process is iterative, and the system is refined over time to improve its accuracy and efficiency. The system is continually retrained and updated with new data to ensure that it adapts to changing conditions and provides the most accurate decisions possible.

AI in Financial Industry

AI has the capacity to transform the financial sector through its ability to enhance decision-making, optimize processes, and minimize expenses. The potential applications of AI in finance are vast and varied, encompassing domains such as banking, insurance, investment management, and trading. In 2022, the market value of AI in finance was estimated to be $12 billion, with projections indicating that it could reach $70 billion by 2030. However, the potential impact of AI on employment remains a topic of debate, with some predicting significant job losses or job degradation due to the introduction of AI. Goldman Sachs, for instance, has forecasted the loss or degradation of 300 million jobs as a result of AI.

One of the most promising applications of AI in finance is in the area of risk management. By analyzing vast amounts of data from different sources, AI systems can identify potential risks and anomalies in real-time, allowing financial institutions to take preventive measures to mitigate them. AI-powered fraud detection systems can also help prevent financial crimes such as money laundering and identity theft.

Another area where AI can make a significant impact is in investment management. By analyzing historical data, AI algorithms can identify patterns and make predictions about future market trends, helping portfolio managers to make better-informed investment decisions. AI can also assist in portfolio optimization and asset allocation, resulting in better returns for investors.

In trading, AI systems can help traders make more informed decisions by providing real-time market data and identifying trading opportunities. AI algorithms can also help automate routine tasks, such as trade execution and reconciliation, freeing up traders to focus on more strategic activities.

The potential applications of AI in the financial industry are vast, and its adoption is expected to grow in the coming years as institutions seek to improve their operations and stay competitive in a rapidly changing business landscape. However, it is essential to note that the adoption of AI in finance also raises ethical and regulatory challenges that must be addressed to ensure that the benefits of this technology are realized without adverse consequences. We will continue to shed light on the Revolutionizing impact of AI in Finance in our next articles.