It’s been more than a month since Russia invaded Ukraine. Unfortunately war affects almost everything, including infrastructure, commodity prices, supply chain, communication, transportation etc. In this article we focus more on the economic effects of the war. In economic environment, the war results increase in price indexes, reduction in GDP growth and causes more and more unemployment as we are facing now. In this study, we try to examine the economic impacts of the Russian invasion. Before starting, I wish God’s mercy on all the innocent people who lost their lives in the war, and condolences to their families. I wish that this war, which started purely because of the personal aggression and madness of the Russian President, will end as soon as possible.

The impact of the Russian invasion on the Ukraine’s economy and its trade partners

Ukraine economy

Ukraine is a developing free market economy. It grew rapidly from 2000 to 2008, suffered from global financial crisis in 2008&2009. Ukrainian economy recovered in 2010 and continued to improve until 2013. From 2014 to 2015, it experienced a serious setback, and in 2015 its GDP fell to just over half of its 2013 value (from $183 billion to $91 billion). In 2016, the economy started to recover again. As of 2021, the Ukrainian economy grew rapidly, and reached almost 90% of its 2013 size with the GDP of approximately $165 billion.

Unfortunately The Russian invasion is a complete disaster for the Ukrainian economy. According to Oleg Ustenko, senior economic advisor to the Ukrainian Government, Russian forces have so far destroyed at least US$100 billion worth of infrastructure, buildings and other physical assets. The destruction of the country caused very difficult times for Ukrainian people. The United Nations High Commissioner for Refugees reported that ten million Ukrainians left their homes due to the Russian invasion. An estimated 6.5 million people are thought to have been displaced within the war-torn country, along with the 3.6 million who went to neighboring countries. Economic life in Ukraine, therefore, came to a standstill. The priority of the Ukrainian people, who struggled to survive under very difficult conditions, was of course not the economic activities, but to survive and defend their lives and their country.

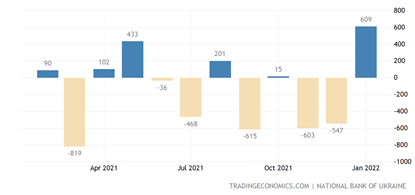

Before the war, the current account surplus reached a record high $5.2 billion in 2020 and has remained positive, driven by strong net services exports and higher global commodity prices. In 2021, Ukraine’s imports of goods and services were about $80 billion, and exports of goods and services were about $81 billion. Accordingly, the foreign trade balance followed a positive course with the contribution of service exports, which is an important success in Covid19 times.

This success of Ukraine compared to previous years, especially in the export of wheat, corn, sunflower oil and iron-containing metal, was unfortunately interrupted by the war. Due to the war, the Ukrainian economy can only survive with international aid at the moment.

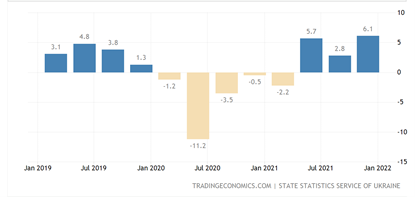

Ukrainian GDP Growth in last 3 years:

The Gross Domestic Product (GDP) in Ukraine in last 10 years:

Current account Balance of Ukraine in last 10 years:

Trade Partners of Ukraine

The Ukraine war has and will continue to have many direct and indirect reflections on the global economy. Direct effects felt primarily on Ukraine’s largest trade partners.

In 2020, Ukraine imported $56.1 billion, making it the world’s number 47th trade destination. In 2020 Ukraine’s imports are led by Refined Petroleum ($3.59B), Cars ($3.35B), Packaged Medicines ($2.04B), Petroleum Gas ($1.59B) and Coal Briquettes ($1.25B). The most common import partners for Ukraine are China ($7.46B), Russia ($6.31B), Poland ($5.68B), Germany ($5.25B) and Belarus (3.15B).

In 2020, Ukraine became the world’s 46th exporter with a total export of 52.7B dollars. As of 2021 The largest export countries of Ukraine are China (about $8 billion) Poland (about $5.23 billion) and Turkey (about $4.14 billion). In 2021, Ukraine’s major exports were ferrous metals (about $10.5 billion), grain crops (about $8 billion), fats and oils of animal or vegetable origin ($5 billion).

A detailed observation among the top importing countries from Ukraine reveals a dramatic result for some countries. China – top importer – imports the highest amount of sunflower seeds and oil from Ukraine. China imports %66 of its wheat from Ukraine and %30 of it from Russia. This makes China the most vulnerable country in terms of sunflower seed and oil price increases . A very similar result is valid for India too. India is dependent to Ukraine (%75) and Russia (%18) in terms of sunflower oil and seed.

Ukraine alone provides about half of the world’s Crude sunflower-seed exports. Sunflower oil and vegetable oil prices increased by around 30% due to the supply constraints with the war. These increases primarily affected China and India, which are among the largest importers. However, since sunflower oil can be substituted with other oils, price increases are not expected to increase further.

Sanctions against Russia

Russia faces a huge isolation and tremendous economic sanctions as it continues to bomb Ukraine. Those sanctions from governments, international organizations and even private sector effectively cut off Moscow’s major financial institutions from Western markets, caused sharp devaluation of Russian Ruble, and triggered a financial crisis in Russian economy which deepens the poverty of Russians more in the future .

Since the beginning of the war, an unprecedented number and variety of sanctions have been imposed against Russia. It is not possible to enumerate all the sanctions in this study, but the following primary examples are sufficient to give an idea. A list of all sanctions against Russia since the beginning of the war can be found in this link (https://graphics.reuters.com/UKRAINE-CRISIS/SANCTIONS/byvrjenzmve/) (source Reuters).

- The United States has banned all Russian oil and gas imports.

- The UK will phase out Russian oil imports by the end of 2022.

- Europe announced that it would make it independent of Russian energy long before 2030.

- Western countries froze the assets of Russia’s central bank to stop using its $630 billion foreign exchange reserves.

- This has caused the ruble’s value to drop by 22% since the beginning of the year. This, in turn, increased the price of imported goods and led to a 14% increase in Russia’s inflation rate.

- Many Russian banks have been removed from the Swift system for international money transfers.

- The assets of many Russian billionaires, politicians and oligarchs were confiscated.

- An increasing number of international companies, such as McDonald’s, Coca-Cola and Starbucks, have ceased their operations in Russia.

The sanctions had a serious impact on Russia’s currency. The Russian Ruble has lost 30% of its value. Some Russian companies lost 98% of their value in international markets. At the day Russia invaded Ukraine, Russia’s main stock index lost a third of its value. The markets had been closed for a month and when the market reopened on March 24, only 33 stocks (several hundred shares) were allowed to trade under heavy restrictions.

Inflation rose 14% in a month and is expected to be over 25%. The Central Bank of Russia increased the interest rate to 20%. Although the sanctions are not able to stop the war yet, from an economic point of view, they are very effective. According to some estimates, real economic activity in Russia is expected to fall between 25% and 30% this year. Russia faces a deep and protracted economic depression that will only get worse as long as it remains isolated from the rest of the global economy.

Commodity prices

Unfortunately, the war deeply affected not only Russia but also the global economy. Since Russia and Ukraine are the largest producers of some basic food products such as wheat (Ukraine and Russia supplies about 30% of worlds wheat production), corn and sunflower oil (Ukraine and Russia supplies about 60% of worlds sunflower oil production) there is a serious supply constraints and cost increases in these products. Due to the war, the prices of sunflower oil, wheat and corn have increased by 30% on average around the world. Since sunflower oil, wheat and corn constitute the input of many other food products, it is inevitable that food prices will increase around the world.

The sanctions and isolation against Russia on the other hand leads to increase in crude oil and natural gas prices. Crude oil prices raised from $90 to $120 and natural gas (futures) prices raised from €75 to € 223 and fell again to € 100 after 1 months. Russia produces 17% of the world’s natural gas and 12% of its oil. In total, about 10% of the world’s energy is provided by Russia. The rise in Oil and gas prices due to the war and sanctions against Russia will increase industry costs and reduce consumer real incomes. Therefore, previous GDP growth estimates have been revised down by approximately 1 percentage point. For example, Fitch lowered its world GDP growth forecast for 2022 to 3.5%, the euro area by 1.5 percentage points to 3.0%, and the US by 0.2 points to 3.5%.

In the chart below, it can be seen more clearly how wheat, crude oil and natural gas prices increased after the war.

The increases in both food and energy prices due to the war will continue for a while. According to forecasts, oil prices will reach up to $150 per barrel. Inflation difficulties and supply shocks, combined with Fed tightening , will have a much more severe impact on the World’s GDP growth.

I hope this meaningless war ends soon. There is no example of a country having benefited from prolonged war.