Global economic prospects continue to deteriorate around the world. These deteriorations, which started with the Corona pandemic process, just initiated to recover, but this time it got worse due to the Russia-Ukraine war. The rising commodity prices due to energy restrictions and embargoes after Russia’s invasion of Ukraine negatively affected the global economy. As a result, a global deterioration began to be observed in all macroeconomic data and expectations, especially inflationary pressure.

Inflation has recently become one of the most important problems in the economies of all countries. Inflation, with its unpredictability, causes serious deterioration in the functioning of the economic system. Because not all products or all factors can adjust their prices at the same time or at the same rate.

Demand-driven inflation occurs when households and businesses are willing to buy more goods and services than the economy can produce. Central banks respond to the possibility of such demand-driven inflation by raising interest rates to slow economic activity, helping to rebalance demand with supply. In this way, by making borrowing more expensive, it is aimed that the demand will not stay above the capacity for a long time with monetary tightening.

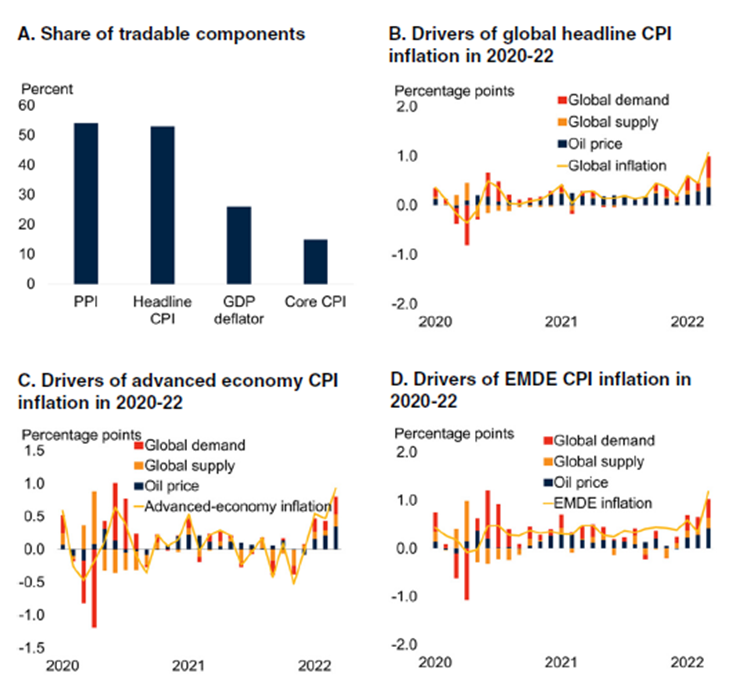

On the other hand, supply-related inflation, mostly stemming from international developments, presents a more complex and difficult situation for monetary policy to deal with. This is especially felt in more foreign-dependent economies. Supply shortages and disruptions ensued when much of the world economy reopened after the initial lockdowns caused by the pandemic. This global recovery has led to serious supply problems in key sectors such as energy, electronics and many consumer durables. Afterwards, Russia’s invasion of Ukraine increased the supply problems and caused the prices of oil, wheat, fertilizer and other production inputs to rise. In this way, since the prices of goods subject to international trade cannot be controlled on a country basis, it is much more difficult to manage due to the effect on supply conditions. Although this situation is perceived as temporary by the countries at first, the shortage of supply and the continuation of the problems in energy prices push the central banks to take very serious measures.

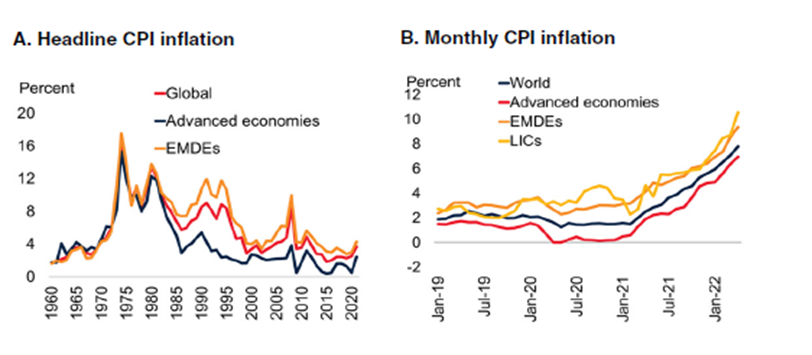

Pricing is a necessary mechanism for consumers to make the right decision about what to buy and for companies to calculate what and how much to produce. In an environment where prices are constantly changing, while producers cannot make a proper pricing policy and cost calculation, consumers will not be able to make a proper shopping decision. Because in an inflationary environment, prices do not fulfill the function of informing both parties. The higher the inflation rate, the wider the margin of error in the expectations of economic agents, and thus the greater the feeling of insecurity. The latest data show inflation at its highest levels in years: globally, at 7.8 percent, its highest level since 2008. Inflation in advanced economies was close to zero in the April-December 2020 period, but now it is in the highest level since 1982. Inflation in developing countries is at 9.4 percent, its highest level since 2008 too, from its lowest level in many years in May 2020. As of April this year, inflation was above target in all advanced economies, with almost 90 percent of developing countries which have inflation targeting (see the graphs below).

Recent empirical studies show how the drivers of inflation have changed since January 2020 and how disturbances related to demand, supply and oil prices affect different inflation measures. While demand shocks were the dominant force in suppressing inflation in the first half of 2020, oil price shocks and supply shocks became more effective in pushing inflation up for core inflation and CPI, especially in advanced economies, starting from early 2021. As consumers, firms, and investors began adjusting their behavior and operations, supply disruptions, along with declines in demand and oil prices, began to ease from May 2020. But since mid-2021, when inflation accelerated and became broader-based, the global growth recovery, rising oil prices and supply shocks—including shipping bottlenecks, non-oil commodity price pressures and wage pressures in some countries—have all been driven by rising inflation. Since the Russian invasion of Ukraine, the rise in oil prices has further increased inflation. The recent increase in inflation has led to a reassessment of near-term inflation expectations. Global inflation is expected to peak in mid-2022 and fall to 3 percent by mid-2023. Russia’s invasion of Ukraine has resulted in further increases in near-term inflation expectations because Russia and Ukraine are major exporters of many commodities

Besides all the other destructive results of inflation, one of the most important problems is its effect on income distribution. In an inflationary environment, wealth shifts from creditors to debtors. For example, the lender will find that when he takes it back, what he has received is less valuable than what he has lent. Or those who save are punished by losing the value of their investments held in cash or similar. Those who spend more than their income by borrowing are rewarded for their extravagance and waste. In general, all fixed-income buyers (retirees, investors with fixed-income securities, rental homeowners with non-indexed contracts) will see the purchasing power of their income decrease. Those who have to pay these rents (State, issuing companies, lessees) will get an undeserved benefit.

Concerns about persistently above the target inflation prompted central banks in most advanced economies and many emerging economies to tighten their monetary policy. Despite this tightening, as of May 2022, real policy rates (interest-inflation gap) remain seriously negative both in developed and emerging economies.

Risks of Inflationary Environment

There are significant risks that inflation could rise more than currently projected or remain high for longer. Inflation may remain above the target ranges of central banks in many countries if supply cuts persist or commodity prices continue to rise, primarily in the case of prolongation of the Russia-Ukraine war or recurrent pandemics and movement restrictions in many countries. If inflation remains high, the risk that high inflation expectations will turn into wage and price-setting behaviors will increase together with the deteriorated pricing behavior.

Inflation acts as a hidden tax: for example, if the central bank puts notes into circulation that see their value decrease by 25% a year later, those who have held these notes for one year will face extortion of a quarter of their cash; other beneficiaries of this tax are all banks involved in the money creation process, as well as the issuing bank.

The increased risk will result in an increase in the cost of money. The interest rates at which money will be loaned should increase the regular payment for two reasons: the need to meet the depreciation of the principal and the risk of not being able to accurately estimate that depreciation.

Investment will be discouraged for many reasons. In addition to the increase in interest rates, the entrepreneur will have additional difficulties in estimating the benefits of his activity due to uncertainty in the future prices of factors, intermediates and final products. During periods of strong inflation, the safest and most profitable investments are often those of a speculative nature: jewelry and art, real estate, foreign currency and foreign securities act as a perpetual store of value. When a very solid supply coincides with a large increase in demand, their prices can grow exorbitantly, thus yielding benefits far greater than any productive investment.

In recent years, inflation has actually not only exceeded the targets of central banks, but also consistently exceeded because of expectations. More recently, inflation has been exacerbated by Russia’s unjust invasion of Ukraine. It also further increased the prices of energy and other commodities, which feed inflation all over the world. And this inflation is painful for everyone, especially those with fixed or low incomes. Over the long run, high inflation may hamper the ability of central banks to meet their inflation targets. This is because the inflation is self-feeding if it leads households and businesses to expect higher inflation in the future. In this self-feeding process, overall prices rise because other prices (for example, labor costs) rise and thus production costs rise. Labor cost rises as workers want to keep up with higher prices for goods and services. In this case, no external force, such as a shortage of supply or a stronger demand, is needed to feed inflation. The main driving force is the deterioration of the pricing behavior due to expectations that inflation will remain high or continue to rise.

How to Fight Inflation?

The main purpose of the Central Banks in the long-term monetary policy is to ensure and maintain price stability. In order to achieve this goal, Central Banks implement monetary policy strategies that they have determined in advance and that cover a certain period. For this purpose, the basic variables of the economy are used in the determination and implementation of the said strategy. These variables are used as intermediate targets to reach the price stability objective.

Historical data and experiences show that once high inflation stabilizes, it is difficult to bring it back without seriously hampering the economy. It is much more desirable to prevent high inflation from becoming entrenched and commonplace than trying to eliminate it once.

Over the past year, household inflation expectations in many countries have risen with real inflation. For example, a larger proportion of US households today than in pre-Covid times expect inflation to exceed 10% in the next five years. Communication by central banks can help stabilize inflation expectations by explaining why and how they take appropriate monetary policy actions to achieve their goals. However, it is much more difficult than for market professionals to manipulate this segment through official central bank communications, as households may be rationally inattentive to monetary policy discussions and actions. Most importantly, households may be insensitive to price changes when inflation is low but become more sensitive when inflation is high and quickly revise their expectations upwards. This, in turn, may be a harbinger of inflation becoming entrenched. Even if the necessary monetary policy measures have been taken, they need time to have an impact on inflation. Another challenge arises because central banks’ official communications typically reach households indirectly. That is, the statements and actions of central banks reach households through sources such as traditional media commentators or through social media posts by third parties. While media outlets tend to play the biggest role in shaping the narrative of the public debate on inflation, they may not fully cover monetary policy news or all its nuances (Pinter and Kočenda (2021)). Also, most consumers do not fully understand the connection between inflation and monetary policy. Ultimately, some households may overestimate central banks’ ability to influence inflation or lose faith in central banks when inflation rises (Grosse-Steffen (2022)). Regardless of their accuracy, household perceptions and expectations are important for individual decisions, broader inflation dynamics and public debate, all of which affect both central banks and governments. Failure to effectively communicate and build understanding with the public can undermine the credibility of central banks and trust in management. However, once high inflation is reflected in expectations, that is, it has become a reality, communication alone is insufficient.

Initial disruptions to international supply chains continued for longer and expanded more than expected, partly reflecting strong demand in the world economy. Therefore, the risk that inflation expectations may deteriorate and high inflation may set in is now greater. While short, medium and long-term inflation expectations are rising all over the world, long-term inflation expectations are still close to pre-pandemic levels.

Therefore, in order to align demand with supply and prevent inflation from settling, central banks must provide monetary tightening by raising interest rates. Almost all central banks, especially the FED and ECB, are taking steps in this direction by increasing interest rates or other tightening measures. Tightening steps are being taken, not only with interest rates, but also with some other balance sheet reduction transactions, which may cause recession in the economies. This is one of the most important movements underlying the fight against inflation. It should be considered normal for central banks to react so quickly and sharply, as the current priority is to prevent entrenched inflation and get things back to normal.

Financial market-based inflation expectations have already risen with Russia’s invasion of Ukraine and supply disruptions from pandemic outbreaks and containment measures in major emerging economies. There are also concerns that a more substantial stabilization of inflation expectations may occur, which will strain major advanced economy central banks. That’s why it’s taken the risk of tightening policy more than currently anticipated, slowing growth, and even putting some economies in recession.

We will continue with the measures taken by countries in the fight against inflation in our next article.