Cryptocurrencies have somehow entered our lives since 2009. Although they are criticized for being used for illegal activities, many investors have accepted and used cryptocurrencies as an investment and payment tool. So how safe is it to invest more in cryptocurrencies? How legal and how ethical is it to own and sell them. In this article, we will seek answers to these questions. While searching for these answers, we will first briefly summarize the history of cryptocurrencies, then analyze the losses experienced in cryptocurrencies over the years. We’ll take a look at which countries legally accept cryptocurrencies and in which countries they are banned. Finally, we will consider whether cryptocurrencies are still good investments.

What is cryptocurrency

Cryptocurrency is a digital, online, and decentralized currency that can be used to purchase goods and services. Like online banking, cryptocurrency networks use mathematical methods called strong cryptography that transforms user and account information into unintelligible codes. Blockchain is one of the fundamental technologies that distinguish crypto money systems from today’s online banking systems. Usernames, passwords, and every other information about money transfers are encoded in different virtual blocks, and access to this blockchain is only possible by the user himself. Blockchain technology is what makes cryptocurrencies independent and untraceable from the central authority. In many countries, it’s legal to sell and buy cryptocurrencies.

History of cryptocurrencies

Although we have only recently heard about cryptocurrencies, the inventions that played an important role in their emergence date back to the 1980s. American cryptographer David Chaum founded an electronic money system called eCash in 1983, and an electronic money company called DigiCash in 1990 and laid the foundations of the crypto money system with Blind Signature technology. However, the first use of the term “cryptocurrency” started in 1998 with the invention of the electronic money system called “b-money” by the Chinese computer engineer Wei Dai. After the global economic crisis that affected the whole world in 2008, trust in the central authorities decreased, and individuals began to seek savings and investment methods that are far from the control and access of institutions such as the state and banks. Bitcoin, the first example of crypto money, was developed and launched by a person or group nicknamed Satoshi Nakamoto, whose real identity is not yet known, in 2009, right after the global economic crisis. As of June 2022, there are more than 18 thousand cryptocurrencies with a total market value of approximately $ 1 trillion worldwide.

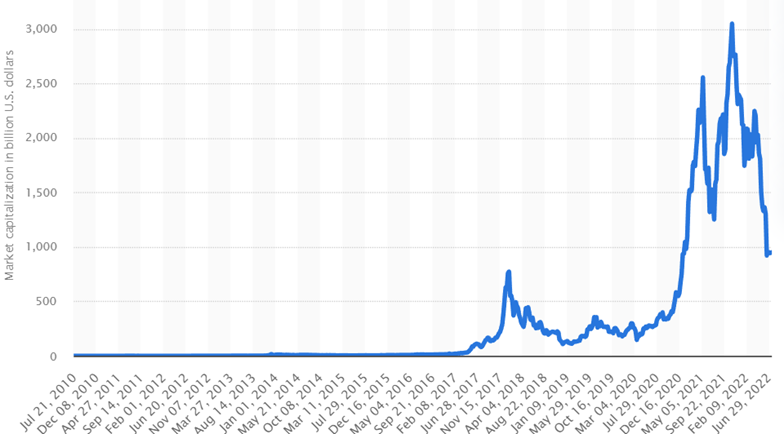

The amount of market cap can give a good idea to understand the volume reached by cryptocurrencies all over the world. The market cap of cryptocurrencies is calculated by multiplying the price of virtual currencies by the number of coins in the market. As of November 10, 2021, the total market capitalization of cryptocurrencies reached the historically high $3 trillion. At the end of 2021, that was around $2.3 trillion. A comparison with the US Stock Exchange capitalization would give a good idea about the size of the crypto market. The market value of the US stock market, which accounts for 60% of the entire world stock market, was approximately $54 trillion at the end of 2021. As of December 2021, the total market cap of cryptocurrencies accounted for about 4% of the US stock market value. It fell to approximately $950 billion as of July 11, 2022, after a dramatic decline in 2021 and 2022.

Cryptocurrency investors have brought a lot to date, but there have also been huge losses. The rapid developments and digitalization in payment systems in the recent period have made the number of gains and losses in the crypto money market very high and fast. There have been 4 main crashes in the history of cryptocurrencies. In January 2018, after a long period of a bull run in 2017, there was a boom. In June 2021, the index consistently showed extreme fear among investors, and one of the biggest reasons was the negative sentiments that spread about the crypto market like wildfire after China Anti-Crypto Crackdown. In November 2021, after the historical peak of 68.000 USD of Bitcoin and other cryptocurrencies, there was another boom.

The Fall in March 2022 is driven by different factors. Cryptocurrencies have lost 70% of their values in general in the last 7 months. The losses experienced in 2022 occurred for different reasons compared to previous years. The main reasons for this are the war in Ukraine, inflation fears, higher interest rates, and increasing frauds and bans on cryptocurrencies. Among others, Bitcoin is the first and foremost well-known cryptocurrency. We will also analyze the gains and losses in cryptocurrencies over bitcoin.

Bitcoin rose from $0 when it was launched in 2009 to about $30 in June 2011. This means a gain of about 3000%. But then, in November 2011, it decreased to about 2 dollars. Bitcoin rose from $13 to $230 in April 2013 but dropped below $70 a few months later. At the end of 2013, bitcoin surged above $1200 with a dizzying increase and fell below $700 3 days later. It fell to the level of 300 dollars in 2014, exceeded 1000 dollars again in 2017, and rose to the level of 20 thousand dollars at the end of the year. It generally showed a horizontal movement in 2018, falling below 10.000 dollars in 2019, but with the pandemic, it entered a rapid upward trend again and reached a historical record level of 69.000 USD in 2021. With the losses in 2022, the value of Bitcoin, which decreased to 18.000 USD, is now approximately 20.000 dollars.

As in all financial investment instruments, the main factor that determines the price of cryptocurrencies is the supply-demand balance. However, the absence of legally regulated and supervised exchange in crypto markets in many countries, compared to other investment instruments, causes destructive price movements in the market. Undoubtedly, the motivation of profit is the primary source of these very high fluctuations in the value of bitcoin and other cryptocurrencies.

Unlike traditional investments, such as stocks, where price movements can be affected by business performance, bitcoin has no underlying assets. This means that movements in price are based entirely on investors’ speculation as to whether it will rise in the future. Investors, who follow the market closely and can access information very quickly, can make very high purchases and sales in order to benefit from the falling and rising markets, and thus, they can change the market price at a level that can be manipulated. The fact that cryptocurrencies do not have to be sold in a regulated market, or in other words, the reality that individuals can send and receive bitcoins directly to each other’s wallets, increases the severity of fluctuations and increases the possibility of scams. Additionally, some huge Frauds also lead to price volatility.

According to Chainanalysis, cryptocurrency-based crimes hit an all-time high in 2021, rising from $7.8 billion in 2020 to $14 billion in a year. In June 2022, Binance, one of the world’s largest cryptocurrency exchanges, paused bitcoin withdrawals. In early 2022, it was reported that Russia may ban cryptocurrency transactions. In June 2021, banks and payment institutions in China were told to stop allowing crypto transactions, and the Chinese government banned the mining of currencies. Then in September 2021, all crypto transactions were declared illegal in China. In May 2021, Elon Musk announced that digital payments would no longer be accepted for Tesla Cars. In August 2021, the UK regulator Financial Conduct Authority blacklisted Binance. All these negative developments are causing the confidence in cryptocurrencies to reduce and their prices to plummet from mid-2021.

How legal are cryptocurrencies

Cryptocurrencies are legally traded in many countries (more than 100) around the world. In this group, which also includes the USA and European countries, comprehensive legal regulations related to cryptocurrencies have been prepared and put into practice. In some of these countries, especially in America, exchange markets have been organized for the purchase and sale of cryptocurrencies. However, cryptocurrencies are still not legal tenders in these countries.

To date, 2 countries have granted legal tender status to cryptocurrencies. El Salvador and the Central African Republic have accepted Bitcoin as a legal tender.

Some countries have completely banned the use and mining of cryptocurrencies. In 7 countries (China, Bolivia, Bangladesh, Nepal, Egypt, Algeria, and Morocco) the use and mining of cryptocurrencies are completely prohibited.

Cryptocurrencies have partial legal status in 19 countries, as they are prohibited from being used for banking transactions or as a means of payment. In the remaining countries, no legal regulation has been made in this area.

In conclusion, it can be said that trading, use, and mining of cryptocurrencies are legal except in some countries and certain activities are prohibited.

However, due to its decentralized structure and difficulty in tracking, cryptocurrencies are used extensively in the financing of criminal activities and money laundering. Using cryptocurrencies to finance criminal activities or launder money from them is clearly illegal. For example, ransomware attacks have increased tremendously in recent years. In a ransomware attack, the attacker infiltrates the victim’s systems, encrypts them, and demands payment in bitcoins to unlock them with a key. As this transaction is a crime, the bitcoins obtained in return are also considered criminal. According to the Chainanalysis report, $8.6 billion was laundered using cryptocurrencies in 2021. This amount signals a 30% increase compared to 2020.

Is it still wise to invest in cryptocurrencies?

Considering the way that cryptocurrencies have passed since their emergence, it’s not hard to say that they will continue to pay their investors over the long term despite the losses in 2022. However, the downward trend in cryptocurrencies is expected to continue in the short and medium term as long as inflationary pressures persist and the FED and other developed country central banks continue to increase interest rates. On the other hand, if inflation and interest rates remain stable or fall in the near future, Bitcoin, which returned from the 18.000 USD low and held at 20.000 USD, could rise dramatically again and reach 100,000 USD in 3-5 years.

However, as explained above, cryptocurrencies carry much more risks than other investment instruments. There is a possibility that your investment will turn into a large amount of profit, but on the other hand, the risk of loss can be very high and fast. Due to the high volatility of the market, the probability of loss increases, especially in short-term investments. Given that early entrants hold large amounts of cryptocurrencies and thus manipulate the market, it may be prudent for small investors to invest their savings in less risky investment vehicles such as central bank cryptocurrencies or bonds.

Ethical point of view

When we approach the issue from an ethical point of view, a very different picture emerges. Today, a significant part of cybercrime is financed by cryptocurrencies. Illegal trade on the dark web, drugs, human trafficking, and even terrorism began to be paid in bitcoin. Of course, it is not illegal for an investor to buy and sell cryptocurrencies without being associated with a crime. However, due to the decentralized finance (DeFi) nature of cryptocurrencies which breaks the buyer-seller relationship makes it difficult to track those illegal activities. In this respect, it would not be an exaggeration to say that every crypto money purchased indirectly contributes to the financing of illegal activities with cryptocurrencies.

References

What Determines Bitcoin’s Price?

Crypto scammers took a record $14 billion in 2021