Central bank digital currencies (CBDC) are becoming more common and attracting more attention. In our previous article, we gave information about the general framework of CBDC. (https://economyandfinanceforum.com/2022/06/02/what-is-central-banks-digital-currencies/) As we mentioned in this article, some countries have taken concrete steps to progress in this regard. While the framework for CBDC continues, there is still much unknown about CBDCs or how they are used. If a decision is made by central banks to issue a CBDC, it is clear that a special study in the payments ecosystem will be required on the expertise, distribution channels, and experience of the process.

In recent years, central banks and related parties have continuously debated whether issuing a CBDC makes sense for their economies, and if so, what a CBDC should be and how it functions. Indeed, issuing a CBDC is likely to have -good or bad- unpredictable effects on economies. This is the nature of innovation. Central banks need to be clear about their CBDC issuance and have very clear policy objectives when deciding whether or how to create a CBDC. The decision to create a CBDC should be given by central banks and should reflect a bank’s objectives, planning, and resources.

OUTLOOK IN CBDC ISSUING COUNTRIES

The emergence and increased use of digital currencies, along with the declining use of physical cash in some parts of the world, presents new opportunities and risks for central banks. In turn, many countries are exploring the possibility of launching a central bank digital currency. However, many different approaches and designs are being considered, given the different needs and situations of each country. Incorrect design can lead to an inadequate system or even have an undesirable negative impact on the financial services industry.

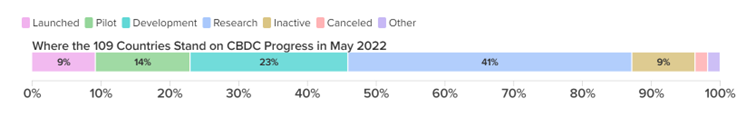

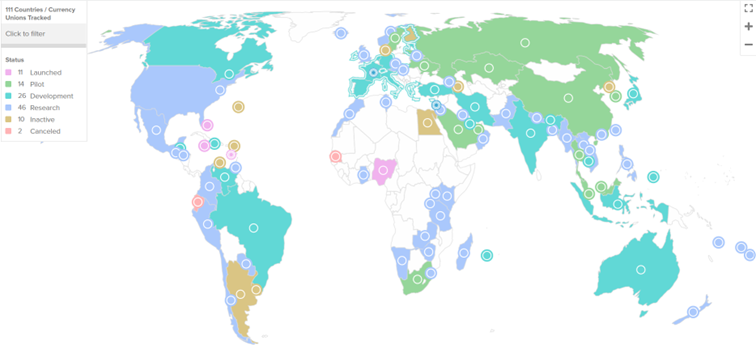

According to the Atlantic Council, 109 central banks have announced in the past few years that they are exploring a CBDC. Below the proliferation of CBDC projects over the last few years can be seen.

In January 2022, the United States Federal Reserve, released a public discussion paper to examine the pros and cons of a potential US CBDC. In this paper, it is declared that a US CBDC “would represent a highly significant innovation in American money”. On the other hand, Mexican President Andrés Manuel López Obrador in December 2021, announced that Mexico’s central bank will launch its own CBDC by 2024. Both of these announcements followed a wave of similar declarations.

Another new survey question showed that most central banks (76%) working on a retail CBDC are exploring interoperability with existing payment system(s). Interoperability can encourage the adoption of CBDCs and enable the coexistence of central bank and commercial bank money. Payment system interoperability enables banks and other payment service providers (PSPs) to make payments across systems without participating in multiple systems. This would allow end users to seamlessly move their money in and out of their CBDC accounts, for example from and to their commercial bank accounts using a credit card or electronic money transfer.

MOTIVES BEHIND CBDC ISSUING

How the central bank designs and then builds a CBDC depends on the objectives the bank seeks to realize through its issuance. Wholesale CBDCs are used for transactions between central banks and other financial institutions, whereas retail CBDCs are used for everyday person-to-person or consumer-to-merchant transactions and are available to the public.

Every central bank researching a CBDC has its own motivations and priorities for doing so. In some cases, the challenges central banks are trying to solve with a CBDC, such as financial inclusion, are problems central banks have struggled with for decades. However, there are other concerns, such as the increased use of privately issued crypto assets in their jurisdiction. Here are some examples:

Effectiveness of Monetary Policy: The growth and widespread adoption of crypto assets and stablecoins are seen as a risk to central banks’ monetary policy implementation and success. As seen recently, some of the investments may shift to crypto asset exchanges that are not yet regulated and cannot be followed. This, in turn, may reduce the effectiveness of the monetary policy. To avoid this situation, central banks see the creation of a CBDC as a public sector alternative that can provide many of the attractive features of crypto assets, and they specifically plan to issue a retail-type CBDC.

Public Access to Central Bank Money: With the Corona pandemic, people in many developed countries have started to use less cash and more digital payments in their daily trade. As cash usage dropped, so did the public’s access to central bank money, raising questions about the effectiveness of central banks. For example, in the last ten years, the rate of cash payments in Sweden has decreased from 39 percent to 9 percent. The Swedish Central Bank, on the other hand, plans to complete its declining activity on the cash side with CBDC. And with the decline of cash use like this and the growth in digital payments, central banks may see CBDC as an effective way to ensure public access to central bank money and capitalize on the digital shift in consumer behavior.

Financial Inclusion: Approximately, 1.7 billion adults in the world do not have a bank account. The introduction of CBDC will have the greatest impact where the level of financial and digital exclusion is high and where a large of the population is unbanked and cash usage is high. According to a World Bank study, “In spite of the contraction in economic activity, mobile money grew twice as fast as had been forecast for 2020, at 12.7 percent, reaching 1.2 billion accounts.” The creation of a CBDC in and of itself does not solve financial inclusion, but how a government markets the CBDC and designs it could provide some secondary benefits. CBDC possibly could ensure no minimum balance requirements to attract unbanked consumers to CBDC accounts.

Competition and Integration: CBDCs also have the potential to encourage competition if they act as a neutral technology platform for payment systems. For this, central banks will need to build the integration of CBDC infrastructure and existing payment systems well. For example, it can facilitate collaborative participation among central banks, financial institutions, fintech, wallet holders, and others in the ecosystem. To further encourage innovation, central banks can develop common standards and foster a developer-friendly ecosystem to foster the growth of value-added services.

Resilience in Crisis: CBDC can also be seen as a means to address long-standing problems of distributing central bank money to geographically remote areas or to people in times of crisis. For example; the Central Bank of Japan sees CBDCs as a way to ensure that the public has access in times of emergency and that individuals can still have access to payments when in the event of “system and network failures as well as electrical outages” and ensuring that a CBDC can still be accessed “offline” during natural disasters. Moreover, the Corona pandemic has also shown that distributing emergency payments can be costly and difficult for governments when people do not have access to a bank account.

FUTURE CHALLENGES

As central banks and policymakers consider the different objectives for issuing a CBDC, they also need to discuss how these objectives may bring new risks. Because, as with every new product, some new risks may arise in the issuance of CBDC. For example, for a currency that will be accessible to the public in the digital world, a cyberattack risk may arise, among other traditional risks. Therefore, it is essential for authorities or central banks to plan a CBDC issuance by considering the benefit-risk balance. Because any situation that shakes the reputation of central banks, which are institutions of reputation, can bring great losses.

The greatest difficulty in the use of CBDCs will arise at the point of public acceptance of it. Since CBDCs are not widely used yet, it is too early to say anything clear about this. An example of a similar situation is the Dinero Electronico of Banco Central del Ecuador in Ecuador, for a failed application of electronic central bank money. The most important argument put forward as the reason for the failure in this practice is that the central bank and government of Ecuador failed to convince the public of the benefits of using electronic money. Therefore, it is possible that the public will not be interested in products that they are not fully convinced of. As such, CBDC design should be made accordingly, taking these examples into account in assessing future challenges for CBDC adoption.

Another risk that may arise from CBDC is related to financial stability. For the issuing country, the CBDC can have a significant impact on credit creation and monetary policy transmission as well as on bank funding sources. Even though CBDC is perceived primarily as a payment mechanism, it will also affect the monetary base due to the shifts that will occur from bank deposits to CBDC assets and the change in the amount of broad-based money supply. Dramatic changes in bank deposits may restrict not only bank loan extension limits, but also increase funding costs.

Because CBDCs are digital products, they can bring significant cyber risks. The parties involved in the process, including central banks as the issuing and infrastructure party, and private institutions involved in the CBDC distribution process, are open to cyber security risks. This area will also be interesting for cybercriminals who want to infiltrate and steal the system after a CBDC issuance, and other states that want to infiltrate the critical infrastructures of another country. Thus, cyber actors can disrupt a CBDC by targeting the central bank that issues a CBDC or commercial banks that distribute it to the public.

Central banks should not act alone while struggling with these difficulties in the process but should manage the difficulties together with all the participants in the process. It is inevitable that central banks will benefit from private sector expertise in payments and technology. This can encourage software and other technology developers to create interoperable solutions with CBDC. Therefore, private sector players will be more involved in the distribution of digital currency, while central banks will focus on the regulation and supervision part. Therefore, both the central bank and private sector participants will each be involved in the risk management process.

- https://www.atlanticcouncil.org/cbdctracker/

- https://www.riksbank.se/globalassets/media/rapporter/arsredovisning/engelska/annual-report-2020.pdf

- Demirguc-Kunt, Asli; Klapper, Leora; Singer, Dorothe. 2017. Financial Inclusion and Inclusive Growth: A Review of Recent Empirical Evidence. Policy Research Working Paper; No. 8040. World Bank

- https://www.worldbank.org/en/about/annual-report#:~:text=In%20fiscal%202021%2C%20the%20World,%241.3%20billion%20in%20IDA%20commitments.

- https://www.kansascityfed.org/documents/7583/psrb20maniff1202.pdf

- https://www.bis.org/publ/arpdf/ar2020e.htm

- https://scholar.google.de/scholar_url?url=https://mpra.ub.uni-muenchen.de/111389/1/MPRA_paper_111389.pdf&hl=tr&sa=X&ei=nooEY9HROov8mgHYs4fIBA&scisig=AAGBfm315qj9NGO8oFU6PAMgkDHw7Pvf0g&oi=scholarr

- https://www.bis.org/publ/bppdf/bispap125.pdf

- https://www.bis.org/publ/bisbull49.pdf

- https://ideas.repec.org/a/eee/lajcba/v2y2021i2s2666143821000107.html