While we included more “book and literature” information about inflation in our previous article, we stated that we would touch on country-based developments and measures in our follow-up article. (https://economyandfinanceforum.com/2022/07/05/the-worst-economic-indicator-of-today-inflation/) Now, with this article, we have tried to include the measures and measures taken on a country basis, especially within the scope of the fight against inflation.

The Nightmare of All Countries: Inflation

Inflation has recently become one of the most important problems in the economies of all countries. Inflation, with its unpredictability, causes serious deterioration in the functioning of the economic system. Because not all products or all factors can adjust their prices at the same time or at the same rate.

Pricing is a necessary mechanism for consumers to make the right decision about what to buy and for companies to calculate what and how much to produce. In an environment where prices are constantly changing, while producers cannot make a proper pricing policy and cost calculation, consumers will not be able to make a proper shopping decision. Because in an inflationary environment, prices do not fulfill the function of informing both parties. The higher the inflation rate, the wider the margin of error in the expectations of economic agents, and thus the greater the feeling of insecurity.

If price stability cannot be achieved, that is, inflation occurs, there are various economic costs to society. While these costs tend to be much higher in economies with high inflation rates, recent studies show that significant inflation costs also occur at low inflation rates.

With the growing consensus that price stability should be the most important long-term goal of monetary policy, many countries have taken active steps to reduce and control inflation. What strategies did they use to do this?

Policy Measures Against Inflation

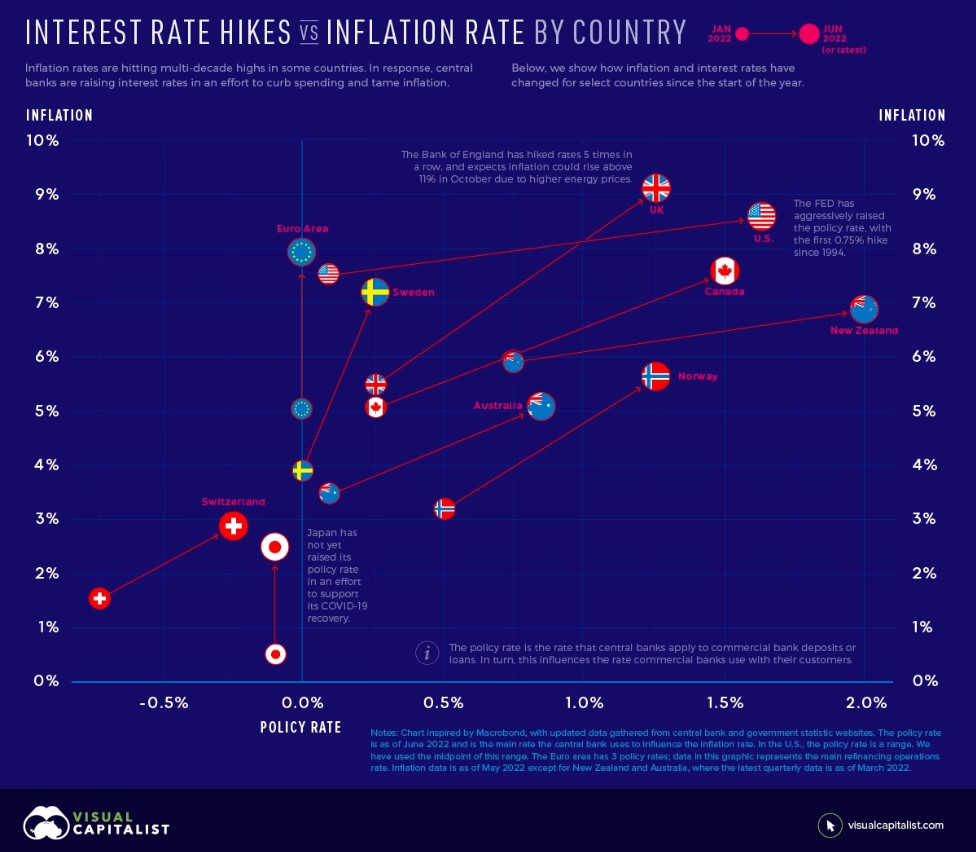

The primary policy for reducing inflation is monetary policy – in particular, raising interest rates reduces demand and helps to bring inflation under control. Other policies to reduce inflation can include tight fiscal policy (higher tax), supply-side policies, wage control, appreciation in the exchange rate and control of the money supply. In terms of economic policy, the optimal solution would be temporarily to cushion the price shock as much as possible, through interventions in the energy market and state transfers. Most countries already have corresponding measures and aid packages. But given the extent of the additional financial burden on households, complete state compensation will not be possible.

Given persistently high inflation rates, the effectiveness of monetary policy measures could decline. This is the case, for example, if, among other things, firms change their price-setting behavior. In an environment of consistently high inflation rates, business owners place relatively little emphasis on current demand and more on expected future inflation when it comes to setting prices. Taken alone, this can reduce the effectiveness of traditional interest rate movements, as the central bank influences demand mainly through changes in interest rates. Still, to rein in inflation, the central bank needs to be more determined in tackling persistently high inflation – in other words, it needs to respond more strongly to deviations from its target.

In the meanwhile, inflation rates have reached decades-high levels in many countries, almost all central banks use interest rates as the most important instrument to combat these inflation rates. In this way, it is aimed to help control inflation by reducing the purchasing power of households, thereby reducing the demand for goods and causing prices to fall. But central banks need to accelerate rate hikes – doing it too fast can bring the economy to a standstill, but going too slow means inflation can snowball. While the US Federal Reserve is the most aggressive with interest rate hikes, the European Central Bank continues to increase interest rates.

Although there are many moves that countries have made or can do to fight inflation, the most basic fighting moves are as follows:

- Governments can use wage and price controls to fight inflation.

- Governments may pursue a contractionary monetary policy, reducing the money supply within an economy.

- Central Banks may implement contractionary monetary policy through higher interest rates and open market operations.

- Central Banks may use reserve requirements to manage the nation’s money supply but dropped these limits until further notice.

Now, we would like to briefly touch on the measures taken within the scope of combating inflation on a country basis.

The USA

In recent months, the U.S. dollar has reached historic high levels in two decades, as the United States Federal Reserve increased its interest rates aggressively since March 2022, amid stubbornly high inflation. Higher interest rates and the relative stability of the United States’ economy have boosted the dollar’s appeal and triggered the ‘flight to safety’ in the international capital market. The impact of the Ukraine conflict on energy prices has deteriorated the economic outlook in Europe, while COVID-19 shutdowns continue to undermine China’s near-term growth prospects. For the developing countries, rising interest rates in the United States, and the appreciation of the U.S. dollar are translating to rising costs of imports, higher inflationary pressures, rising debt servicing and borrowing costs and worsening fiscal and current account balances, undermining the prospects of their full economic recovery from the pandemic.

Minutes released from its September 2022 meeting, at which the FED imposed its third consecutive 0.75 percentage point rate rise, showed that central bankers remained committed to “purposefully” tightening monetary policy in the face of “broad-based and unacceptably high inflation”. US benchmark interest rates currently stand in the range 3% to 3.25%.

ENGLAND

The Prime Minister announced that the average energy bill will be frozen at £2,500 a year to help households. This policy is expected to lower inflation by up to 5 percentage points over the first six months and see typical households save an average of £1,000 a year on energy bills. This support will come in addition to the £37 billion, including the £400 discount through the Energy Bills Support Scheme and the one-off Cost of Living Payments, which will provide £1200 direct financial support to millions of the most vulnerable households, with additional support for pensioners and those claiming disability benefits.

The BOE rate currently stands at 2.25% having been hiked seven times in under a year. The next Bank rate announcement will be on 3 November.

CANADA

The Bank of Canada has been raising its policy interest rate to slow demand growth, anchor inflation expectations and bring inflation down. Slower domestic and foreign demand, lower commodity prices and the fading impact of global supply disruptions will reduce price pressures over the projection horizon. Inflation is expected to return to the top of the 1%–3% control range by the end of 2023 and to the 2% target by the end of 2024.

To lower inflation, the Bank of Canada rapidly raised its policy rate and is undertaking quantitative tightening. These actions, combined with interest rate increases by the US Federal Reserve and other central banks, have led to a rapid tightening in domestic financial conditions over the past year. As a result, economic growth in Canada is slowing, allowing supply to catch up with demand. Housing activity has fallen sharply from the exceptional peak recorded earlier this year. Household spending on goods is slowing, and firms’ plans for investment and hiring are softening. The slowdown in economic activity abroad, particularly in the United States, has also begun to weigh on exports. Over the projection, the weaker Canadian dollar is expected to offset some of the impact on exports coming from slowing foreign demand.

European Zone

Inflation rates across the Eurozone are putting the European Central Bank (ECB) under pressure to raise rates – whilst economic indicators continue to nosedive. The ECB seems nonetheless determined to do “whatever it takes” to bring down inflation, even if “whatever” were to imply a severe recession and permanent damage to the European economy.

The European Central Bank (ECB) has raised its key interest rate by 0.75 percentage points in an attempt to head off soaring inflation levels across the eurozone. The deposit rate, which was negative until August, was raised from 0% to 0.75% and has now doubled to 1.5% following increase.

However, the longer high inflation rates persist, the more it appears they may have become somewhat permanent. As a consequence, the ECB finds itself under increasing pressure from policymakers, the media, and the public. Although energy prices are pushing many firms to the verge of closure, and virtually all economic indicators are in freefall – partly indicating that we are heading towards a crisis of a larger scale than 2008 and the Covid-19 pandemic – the ECB finds itself cornered to take a tough stance. The outlook for energy prices, the main driver of the current inflation, also appears to have a smoothing effect on inflation next year, as energy futures point towards a gentle decline of prices from Q2 2023 onwards.

The Czech Republic increased its interest rate from 0.5 percent to 7 per cent between the summers of 2021 and 2022, whilst inflation continued to climb from less than 5 to over 17 per cent. Slovakia, as a member of the Eurozone tied to the monetary policy of the ECB, had no similar increases in interest rates, yet its inflation went – during the same period – from similar levels of less than 5 percent to around 14 per cent.

GERMANY

The Government presented on Sept. 4 a third package worth 65 billion euros, bringing its total to 95 billion since February. It includes benefit hikes and a public transport subsidy and is to be financed with a tax on power companies and by bringing forward Germany’s implementation of the planned 15% global minimum corporate tax. The finance ministry estimates measures taken since last year will cost 67 billion euros, including 24 billion euros to cover gas and electricity price caps and subsidised rebates on vehicle fuel. Extra spending this year has been covered by better-than-expected tax income, which has allowed to the government to stick with its target for a budget deficit of 5% of GDP.

FRANCE

The Government presented its long-awaited “purchasing power package” to the tune of 20 billion euros. Most of the measures had already been announced, but the government was keen to point out the scale of public funding that has been mobilized since late 2021 to support households stricken by inflation. In concrete terms, the additional 20 billion euros to deal with rising prices (especially those for energy) cover proposals in two bills – one on “emergency measures to protect purchasing power” and a budget amendment to be debated in the Assemblée from mid-July.

Measures to help workers include tripling the tax-free Macron bonus, more flexible use of profit-sharing, a 4% increase in the activity bonus for low-income workers, lower social protection contributions for the self-employed and a 3.5% increase in the civil service salary indexation benchmark as of July 1. Those designed to ease pressure on housing include a 3.5% rent increase cap and a 3.5% increase in housing subsidies. Other measures include early increases in benefits for low-income households and pensions, (up to 4% on earned income supplement, disability allowance, family benefits and scholarships for students), a 100-euro grant for the start of the school year (plus 50 euros per child) for 8 million households

ITALY

The Italian government has so far committed 52 billion euros and flagged plans for a new multi-billion euro package which one source told Reuters could be worth at least 10 billion euros. Outgoing government has financed his packages with increased revenue from value added tax on higher energy costs and by adjusting other areas of the state budget. The government has refused to hike this year’s fiscal deficit above an April target of 5.6% of GDP.

SPAIN

According to the Spanish Statistical Office, the price of basic foodstuffs rose by an average of 30 percent, and energy prices were already rising before the attack on Ukraine. In June 2022, inflation was 10.2 percent, the highest level in 37 years.

On 19 July, Prime Minister Pedro Sánchez presented his second anti-crisis package to combat the effects of inflation and help those most in need. The most important measures of the package are the introduction of extraordinary taxes for electricity companies and banks, the promotion of social housing, a temporary subsidy for local public transport and additional payments for scholarships. The Spanish government says it has mobilized over 30 billion euros. That includes a first package worth 16 billion euros in March made up of direct aid and subsidized loans and a second 9 billion euro package in June targeting people in low incomes with pension increases as well as subsidies for rail and bus transport.

NETHERLANDS

The government has offered general tax breaks and targeted support for low-income households at a cost of over 6 billion euros. It is preparing a further 16 billion euros in measures for next year, including a 10% increase in the minimum wage and higher income-related subsidies for health care and rent, which will mostly be paid for by hiking wealth and corporate taxes and a special levy for oil and gas companies.

CZECH REPUBLIC

Inflation had already risen sharply at the end of last year and now stands at 18%. This remains the highest since 1993. Higher energy prices have been the main contributor to this, but groceries and other everyday necessities have also become significantly more expensive. For many people, this has meant quick calculations when at the supermarket checkout; going out to a restaurant has become a luxury. Many people are also worried that they will no longer be able to pay their electricity and gas bills in autumn and winter. In addition, many energy companies in the Czech Republic have already adjusted their tariffs to the increased purchase prices and passed them on to their customers, so that the actual price increases are already being felt in people’s wallets in a very real way.

GREECE

The government says it expects spending more than 10 billion Euros to help households, which it hopes can be offset with record tourism revenues in order to maintain its fiscal target for a primary deficit of 2% of GDP.

‘Economise!’ is otherwise the motto for the population. One particularly unconventional measure has been introduced: anyone who replaces their old air conditioner with a new, energy-efficient unit will be reimbursed half of the purchase price by the state – and can look forward to lower electricity bills in the future. Subsidies are also available for the purchase of new refrigerators and freezers. According to the government, around 200,000 households will receive such subsidies, saving €150 to €300 per family household per year.

AUSTRIA

The government announced a 6 billion Euro package in June, which includes increased benefits to vulnerable groups and subsidies for energy-intensive companies. The measures are due to push the budget deficit to 4% of GDP.

Scandinavia

Countries are partly using automatic mechanisms to compensate for the effects of inflation, among them Sweden’s ‘Prisbasbelopp’, which roughly means ‘price base amount’. That is regularly calculated by Statistics Sweden on the basis of a consumer price index to help control state benefits, such as student grants, guaranteed pensions, and tax deductions. The sum is calculated according to the change in the price basis amount, with this year’s increase the largest for 40 years.

But not all government allowances are automatically adjusted. For example, the amount of child support does not rise in tandem with inflation, which means relief does not equally benefit all Swedes. The country has also adopted various ad hoc measures, such as tax cuts. In September, Swedish elections and the subsequent budget negotiations will determine what other help will be offered.

Unlike Germany, Nordic countries do not risk the supply problems closely linked to energy prices. Oil- and gas-producing Norway is largely self-sufficient, while the other Scandinavian countries rely on a limited amount of fossil fuel from Russia: Even when most of the gas comes from Russia, as in Finland, it represents only a small fraction of the national energy mix.

ARGENTINA

In 2021, the country’s 48.4 % inflation rate was the world’s sixth highest; in August 2022, it is 64 % year-on-year. High inflation cannot only be traced to rising energy and food prices on the world market. Price trends in Argentina have always been extreme: Between 1980 and 2019, annual average inflation was a staggering 215.4 %.

Government goals are reaching a balanced budget by 2024, accumulating currency reserves and reducing inflation. All hopes are pinned on the new economy minister, who is also in charge of the — previously independent — Economy, Agriculture, and Productive Development Ministries. He has already announced his plan to reduce public spending to keep the budget below 2.5 % of GDP. In addition, no more money is to be printed. If Massa manages to push inflation down to 30 % by the next presidential elections without impoverishing more of the population, his program will be hailed as a success.

Sources:

https://www.ips-journal.eu/topics/economy-and-ecology/protecting-people-from-inflation-6139/

https://www.weforum.org/agenda/2022/07/interest-rate-hikes-inflation-rate-economy

https://www.bis.org/publ/confp04.pdf

https://www.crfb.org/blogs/six-ways-fight-inflation

https://www.ecb.europa.eu/home/search/review/html/inflation-measurement.en.html

http://global.chinadaily.com.cn/a/202206/15/WS62a91905a310fd2b29e62b9f.html

https://www.weforum.org/agenda/2022/07/interest-rate-hikes-inflation-rate-economy/

https://blogs.worldbank.org/arabvoices/mena-4-policies-countries-can-adopt-combat-inflation

Deutsche Bundesbank, Outlook for the German economy for 2022 to 2024, Monthly Report, June 2022, pp. 35-41.

www.voxeurop.eu/en/how-are-eu-countries-doing-against-inflation/