Silicon Valley Bank (SVB) was founded in 1983 in Santa Clara, California as a bank that serves the rapidly developing technology sector in the region and the people who are looking to finance this sector. According to the bank’s own financial reports, in 2021 the SVB financed almost half of all supported ventures in the US. The bank was also the banking partner of many venture capital companies that financed these ventures, and described itself as the “financial partner of the innovation economy”.

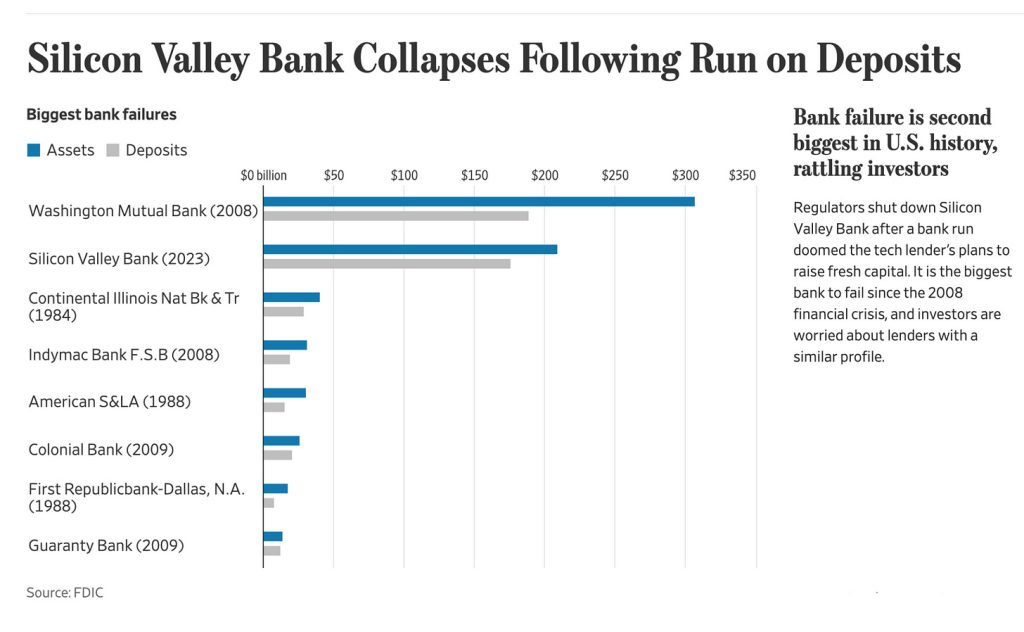

SVB, which has many shareholders, including giant investors such as Vanguard Group with 11.25 percent, BlackRock with 8.05 percent and JPMorgan Chase with 4.25 percent, had an asset size of 212 billion dollars by the end of 2022. This had made the bank in the 16th place in size in the United States. The bankruptcy of SVB, which is shown as the second largest in US history, has also gone down in history as the largest bank failure since the Great Depression.

WHY SVB COLLAPSED?

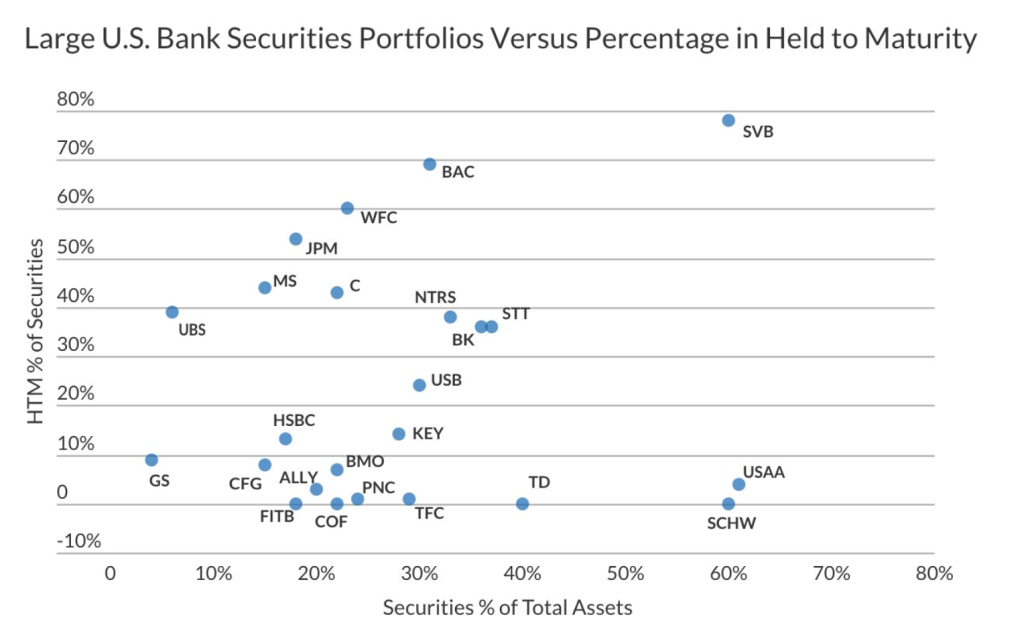

Banks collect deposits from their customers and invest them in areas such as loans or bonds. While the SVB invested a significant portion of its deposits in bonds, the value of these bonds decreased as the Fed increased interest rates. While this is normal situation and not a problem for well diversified banks, that has created a serious problem for the SVB that leads the bank to bankruptcy due to the concentration of bond investments in the bank. In addition, the widespread recession in the technology sector slowed down deposit inflows and customers began to withdraw their money, putting the bank on an irreversible path.

The main problem of the collapse of Silicon Valley Bank is defined as a “liquidity crisis” in the financial literature. “Panicking deposit customers” want to withdraw their money and “run-away” (bank-run) from the bank, which has structurally started to have insolvency/liquidity problems. This escape triggers other customers and the bank can no longer afford deposit withdrawal and eventually has to go bankrupt.

Silicon Valley Bank managed to triple its deposits during the pandemic period between 2020 and 2022. In this, Silicon Valley benefited largely from the abnormal growth of start-up technology companies and their deposits at that time. Rather than investing almost all of its deposits in other start-ups or venture companies, the bank has chosen as a strategy to invest in long-term Treasury bonds and mortgage bonds that provide smaller but more reliable returns. In an environment where general market interest rates were low, this investment strategy seemed reasonable.

On the other hand, low interest rates in the USA began to increase and in 2022 the Federal Reserve (Fed) raised the benchmark interest rate to 4.5, the fastest since the 1980s. The sudden increase in interest rates has severely reduced the value of Silicon Valley Bank’s Treasury and mortgage bonds, resulting in losses on its balance sheet. After a huge withdraw of the tech companies from their deposits, the bank was forced to sell the treasury and mortgage bonds that it had previously invested in for a long time within the framework of its investment strategy in order to provide cash to meet these withdrawals of the customers. In this environment the Bank had to sell the bonds at the big losses in the market.

SVB’s parent company, SVB Financial Group, announced on March 8 that it would raise $2.25 billion in capital, while selling $21 billion of securities in its portfolio at a loss of approximately $2 billion. This statement scared the markets and customers. SVB shares tumbled more than 60 percent two days in a row. Then, when depositors withdrew $42 billion in deposits from the bank in a single day, California banking authorities decided to close the bank.

THEN..

The US Federal Deposit Insurance Corporation (FDIC) has been appointed as the bank’s trustee by the California Department of Financial Protection and Innovation to protect insured deposits.

In the statement, it was noted that the FDIC established the Santa Clara National Bank of Deposit Insurance (DINB) to protect insured depositors, and all SVB’s insured deposits were transferred there. It was stated that all insured depositors will have full access to their deposits by March 13 at the latest, and future dividend payments can be made to uninsured depositors while the bank’s assets are sold.

To address the concerns, the FDIC, the Treasury Department, and the Fed took further action, fearing the crisis would spread more widely, announcing to depositors at Silicon Valley Bank and Signature Bank that all funds were guaranteed, even if they exceeded the $250,000 mark. The government announced an urgent lending program to meet those deposits and restore confidence in the financial system.