BACKGROUND

Over the centuries, various forms of money have emerged to meet the economic needs of the time. Coins, notes, checks, and credit cards were novelties in their time. with the development of the digital world and technology, new ones have been added to these types recently. For example, mobile phone-based payment applications, mobile coins, cryptocurrencies, and finally central bank digital currencies (CBDC). CBDCs can be seen as a digital extension of existing forms of central bank money, namely cash and fiat money. As a digital obligation of central banks, CBDCs could become a new tool for reconciliation among financial institutions.

Since the beginning of the use of “money” money, which is a means of payment, has taken various forms in line with the wishes and demands of the people. In its historical development, it has been observed that the most important function of money among other functions is to be a means of payment. Money, which later became a means of saving value, has changed in line with the demands and requirements of the people. For example, this change in the historical process can be seen as the use of checks, the form of credit cards, bank deposits, e-money, and eventually cryptocurrencies. These ongoing innovations and changes have been motivated by the high cost of storing& transporting cash and the impossibility of using it in non-face-to-face transactions.

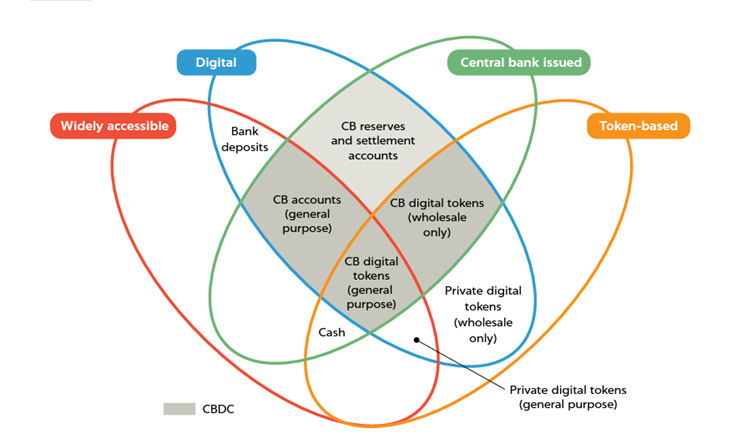

CBDC could potentially be at the center of transactions as a kind of digital currency backed by governments or central banks. The use of CBDCs is not necessarily a complete replacement for physical cash or other forms of money, including new digital currencies. Because the use of new forms of money throughout history has not completely eliminated the previous ones. All these forms of money can coexist. This coexistence may bring more use of some types and less use of others in line with needs and desires. In order to achieve this coexistence important thing is that all these types of money should be widely accessible by banks and non-bank institutions and be guaranteed by central banks. Because central banks are generally responsible for maintaining the public’s trust in money. One of the things we have learned from economic history is that money must be reliable. An unreliable means of the transaction will not work at all and will hurt the market. Therefore, central banks are responsible for the reliability and value of money. In this manner, central bank money is in the form of circulating banknotes as well as reserve and clearing accounts held at the central bank by institutions participating in payment systems. The main difference between central banks’ money and other parties’ money is that the former carries no risk of default, while the latter carries the possibility that its issuers will eventually fail to meet their obligations.

CENTRAL BANK DIGITAL CURRENCIES

Central bank digital currencies are simply digital tokens like cryptocurrencies issued by the central bank of any country. In other words, a CBDC is a digital payment instrument, denominated in the national unit of account, that is a direct liability of the central bank. Recently, many countries have announced that they are developing CBDCs. This topic is one of the most important issues in the world of central banking. In our next articles, we will give details and studies on this subject on a country basis.

Due to the trend and interest in digital currencies, many countries are looking for ways to transition to digital currencies. With the aim of a cashless world in the future, the decrease in the use of cash and the prominence of digital money is among the important issues of the last few years. However, the sudden explosion of cryptocurrencies has turned the direction of digital money into the crypto world. To better understand digital currencies and crypto cash, we must also understand the classical monetary theory. So we have to mention here traditional central bank money and banknotes by the term “Fiat Money”.

In general, fiat currency is a national currency that is not pegged to the price of a commodity such as gold or silver. The value of the fiat currency is largely based on the public’s belief or trust in the issuing entity, which is normally the government or central bank of that country. It is considered a form of legal instrument that can be used to exchange goods and services. In order for it to be used in the exchange of goods and services in this way, it must be a banknote guaranteed by the legal authority. This assurance is given by central banks in almost every country. Traditionally, fiat money came in the form of notes and coins. However, technology has allowed governments and financial institutions to supplement physical fiat money with a credit-based model where balances and transactions are recorded digitally. In other words, fiat money that is created on a credit-based basis through central banks and the banking sector has actually become a separate currency (so-called fiduciary money) that central banks have to manage. Because, besides the physical money, fiduciary money is also one of the most important factors affecting the monetary policy of central banks and it is also a monetary policy management tool.

In fact, fiat money has no real value and is just a piece of paper. The value of this piece of paper is a government or central bank’s assurance that this banknote can be exchanged for the commodity value. Therefore, the value of this currency is basically determined by the credibility of the central bank or government.

Cryptocurrencies are in our lives for more than 10 years and have grown rapidly as important financial access tools around the world with the Coronavirus (COVID-19) pandemic. Due to this widespread use of cryptocurrencies, policymakers are trying to take steps to both take advantage of this trend and prevent possible risks. Many central banks are exploring the possibility of offering digital currency solutions to meet their future payment needs in a digital economy. According to a 2021 central banks survey by the Bank for International Settlements (BIS), 86 percent of central banks are actively exploring the potential of digital currencies, 60 percent are experimenting with the technology, and 14 percent are implementing pilot projects. Some implementations of CBDC initiatives are given below.

Many central banks have pilot programs and research projects intending to determine the availability and functionality of a CBDC in their economy. As of March 2022, there were nine countries that had launched CBDCs. There are 80 other countries with CBDC initiatives and projects underway. Here are some examples:

The issuance of a CBDC can bring significant changes in the use of physical cash. This could result in a very significant change as CBDCs that can be issued by central banks will be available to all individuals and organizations in the economy and their use will be encouraged by central banks. However, it should be kept in mind that there are many people and companies in many countries who prefer to stay out of the digital world and especially use physical money throughout society. It is obvious that especially the elder generations prefer more physical transactions. Nevertheless, it is certain that these initiatives will find a significant response in “generation Z”, which is the generation of the digital age.

In addition, CBDCs to be issued by central banks can replace physical money as a new means of payment and value accumulation in the form of cash in the new digital world. In this respect, it will both provide trust for the parties demanding physical money and support their efforts to move towards a cashless society. This seems to be achievable because money will be issued by the institutions that have the sole authority to issue money, just like physical money, but additionally, this will also appeal to the digital world. At the same time, a digital currency that can be used by more widespread parties will also contribute to the monetary policy goals of central banks. Of course, for these, central banks will need to define all kinds of technical infrastructure and systematic flows very clearly when taking steps for CBDC issuance. Otherwise, it is possible to face more unmanageable difficulties than physical money.

HOW THE SYSTEM WORKS?

Central banks derive their authority regarding money printing and monetary policy from the legal regulations in the relevant country. In this respect, central banks should be given the necessary legal powers in the issuance of CBDCs. In addition, the issuance of CBDC should not conflict with the generally accepted legal objectives, powers, and duties of central banks. In other words, the new environment that will emerge with the issuance of CBDC should be consistent with the duties and targets of central banks. Therefore, in this context, the issuance of CBDC and its related procedures should be designed in detail depending on the purpose of issuance.

After these regulations, CBDC should be accepted as a legal payment instrument throughout the relevant country. Currently, banknotes and coins issued by the central bank are accepted as legal tender. Banknotes and coins are accepted as valid payments in all payment systems in economic life. However, other than that, payments and collections are also made over the money in the bank records (with the credit system or bank deposit accounts), that is, the finance ecosystem revolves around these transactions. Digital money within the banking and digital payment system are also trusted and widely used. Certainly, this trust depends on the Central bank’s assurance. Similarly, in order for CBDCs to be included in this system in the future, this trust must be absolutely established.

For this, a CBDC issuance requires a serious background system infrastructure to make it available to the public. This system will consist of the issuing central bank, operator(s), participating payment service providers, and banks. It may also need to involve other parties, such as data storage and service providers, maintenance companies, and point-of-sale device providers for the system to function flawlessly.

Central banks’ CBDC issuance will continue to be followed with increasing interest. We will continue with more detailed articles on this subject.

Sources:

| 1. | https://en.wikipedia.org/wiki/Fiat_money |

| 2. | https://www.ig.com/en/glossary-trading-terms/fiat-currency-definition |

| 3. | https://www.bis.org/about/bisih/topics/cbdc.htm |

| 4. | The Age of Central Banks, Curzio Giannini |

| 5. | CENTRAL BANK DIGITAL CURRENCY A Payments Perspective, November 2021, World Bank Group |

| 6. | CENTRAL BANK DIGITAL CURRENCY Background Technical Note, November 2021, World Bank Group |

| 7. | https://www.investopedia.com/terms/c/central-bank-digital-currency-cbdc.asp |

| 8. | Bank for International Settlements, Annual Economic Report June 2021 |

| 9. | Designing Central Bank Digital Currencies, IMF Working Paper WP/19/252 |