The most important role of central banks is to ensure price stability (low and stable inflation) and to manage economic fluctuations. To be able to make this, central banks basically carry out monetary policy. The policy frameworks in which central banks operate have been subject to major changes in recent years.

Every day, people around the world make more than 2 billion digital payments. These include paying for goods and services, borrowing and paying, and many other financial transactions. When making these transactions, people rely on the monetary system, that is, the set of institutions and regulations that surround and support the exchange of money. Central banks are, of course, at the center of this monetary system. As a central bank issues money and maintains its core functions, trust in the monetary system ultimately rests on trust in the central bank. However, in this whole system, central banks do not work alone, commercial banks and other private payment service providers provide direct service to customers by making most of these payments.

What is Monetary Policy?

Central banks direct the economy to achieve certain macroeconomic goals through monetary policy. To do this, they use a number of factors, such as the money supply or the cost of money (interest rates). Central banks use the amount of money as a variable to regulate the economy.

With the use of monetary policy, central banks try to manage their economies by controlling the money supply and thus reach their macroeconomic targets and try to keep inflation, unemployment, and economic growth at stable values. The main objectives of monetary policy are:

Controlling inflation: Maintaining a steady and low percentage of price level increases. If the inflation rate is too high, restrictive monetary policy is applied, and if it is low or deflation, expansionary monetary policy is applied.

Reducing unemployment: making sure there is a minimum number of unemployed. To this end, expansionary policies will be used to encourage investment and recruitment.

Ensuring economic growth: To ensure the growth of the country’s economy in order to provide employment and welfare. For this, expansionary monetary policies will be implemented.

Improving the balance of payments: making sure that the country’s imports are not much higher than exports, as this could lead to an uncontrolled increase in debt and economic decline.

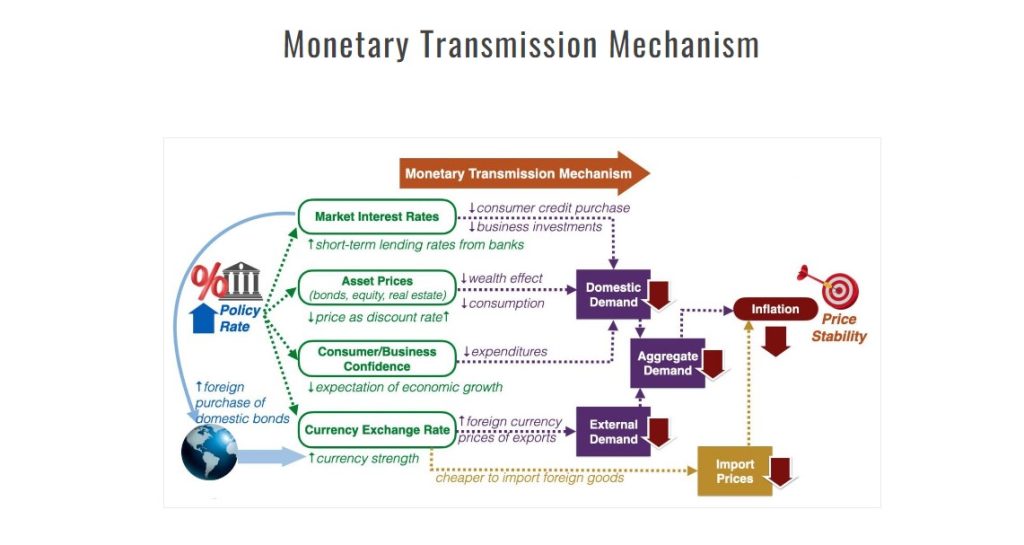

The monetary transmission mechanism refers to the ways in which a change in monetary policy, specifically the central bank’s policy rate, affects the price level and inflation. There are four channels through which a change in the policy rate is transmitted to prices. They are transmitted through their effect on market interest rates, asset values, consumer and business confidence, and currency exchange rates.

Central banks conduct monetary policy by controlling the money supply, usually through open market operations. The money supply control function can be done directly or indirectly. For example, central banks, which have the sole authority to print money, can directly control the money supply by printing money. But they can also indirectly control the money supply, for example, by purchasing government bonds from commercial banks. Or it can indirectly control the money supply in the same way as reserve requirement or liquidity ratios. These transactions are called open market operations. The purpose of open market operations is to drive longer-term and short-term interest rates that affect overall economic activity. In some countries, especially in low-income countries, the monetary transmission mechanism is not as efficient as in developed economies.

After the global financial crisis in 2008, central banks in advanced economies loosened their monetary policy by lowering interest rates until short-term rates were close to zero, which limited the option to cut policy rates further (ie traditional currency options). With deflation in danger of rising, central banks adopted unconventional monetary policies, including buying bonds (especially in the United States, the United Kingdom, the eurozone, and Japan) to further lower long-term rates and ease monetary conditions. Some central banks have even set short-term interest rates below zero.

It is difficult to achieve these goals only by using monetary policy. To achieve these, it is necessary to implement fiscal policies in coordination with monetary policy. In fact, monetary policies have multiple limitations and thus many economists oppose the use of these policies, assuring that they pronounced business cycles. In addition, often monetary policy mechanisms do not achieve the desired goals but instead, change other factors. For example, if we increase an economy’s money supply to drive economic growth, we may only get an increase in prices.

Monetary Policy with Digital Advancements

The monetary system with the central bank at its center has generally worked well so far. Yet digital innovation expands the boundaries of technological possibilities and places new demands on the system. The overwhelming technological advances we are currently witnessing open the door to more widespread use of digital currencies in the near future. In fact, digital developments and applications in the financial world have already started to spread very quickly.

As digital technologies develop and become widespread in the financial world, there has been talking about how to implement a much more widely used digital currency. In recent years, as digital currencies have become widespread in over-the-counter markets, it has been frequently mentioned that they should be regulated and that digital currencies should be issued by public authorities through central banks. There are two alternatives for this: private digital currencies (examples that already exist today, such as bitcoin) or a central bank-guaranteed digital currency (CBDCs). CBDC is a digital payment instrument, denominated in the national unit of account, which is a direct liability of the central bank. For more detailed information about CBDC, you can read the article below on our website.

The word “Innovation” is not only a trendy word but also the name of the change that is in real life and that is experienced at a dizzying speed. Remember the financial markets 10 or 20 years ago and consider the current financial world. Innovation is advancing at rocket speed and shaping the financial markets, as in all other areas of life. Central banks, which have to keep up with this change, are also doing the necessary research and studies. At least central banks that we think are sane and well-managed. Continuing studies at central banks show that it is mindful to keep up with the new world and financial markets order, and it is aimed to take advantage of most of the supposed benefits of digital currencies without the disadvantages. Wholesale and retail CBDCs, FPS, and other reforms in open banking show how central banks can support interoperability and data management. Central banks, of course, are not alone in trying to do this, but they work closely with other public authorities and innovators in the private sector.

In general, central banks have much more resources, knowledge, and technical capabilities to implement an appropriate monetary policy at all times and to maintain the stability of the digital currency as a unit of account, thereby avoiding sudden price fluctuations. Therefore, it can be said that digital currencies to be issued by central banks against a private digital currency will be more reliable. Because it is difficult for a private entity responsible for enforcing a digital currency to have the relevant tools to devise a reliable money supply rule and socially desirable goals such as price stability and economic activity.

Another advantage of a digital currency to be issued by central banks would be that it can increase the effectiveness of the relevant central bank’s monetary policy. For example, if CBDC occurs by allowing households and companies to open accounts directly with the central bank, the central bank can directly set interest rates on households’ and companies’ assets. This can be a complementary tool for central banks where the monetary transmission mechanism is not working well or where monetary policy is ineffective in an environment where private digital currencies are proliferating. In fact, setting an interest rate on CBDC will also affect commercial bank deposits, as they will have to offer sufficiently attractive returns to prevent customers from transferring their deposits to the central bank. This is another factor that will increase the monetary policy effectiveness of central banks.

Proponents of a central bank digital currency, on the other hand, argue that it will improve both some aspects of the functioning of the payment system and potentially improve the transmission of monetary policy. But at the same time, they think that the benefits of CBDC-related monetary policy transmission may remain low and that technological and financial stability risks may warrant prudence. However, as we have just stated, the introduction of the CBCD could have significant implications for the transmission of monetary policy.

In this respect, considering that the CBDC to be issued by the central banks constitutes an alternative to current accounts as a store of value and a payment instrument, the interest rate associated with it has an impact on the borrowing-lending interest rates of different economic units that have access to the CBDC. It will form a base. For example, the interest rate of the CBDC will also be reflected in the interest rates on deposits of households and companies. Therefore, changes in the CBDC rate will affect intermediaries’ spending and savings decisions, either directly through the payment of funds deposited at the central bank or indirectly through their impact on the fee for deposits at commercial banks. Therefore, changes in the financing costs of banks will also affect the interest rates of the loans they give to the real economy. In this respect, CBDC may also have an impact on the profitability and size of the banking sector, due to its effects on the returns on bank deposits. Banks may offer deposit rates above CBDC to prevent deposits from slipping, causing banks’ profit margins to shrink. In addition, this situation may lead to a decrease in the supply and cost of credit, and possibly a contraction in the intermediary capacity of the banking sector, as well as lowering intermediation margins. In other words, the CBDC instrument can be used as an effective market instrument in monetary policy implementations in parallel with the required reserve practices implemented by central banks. That is, CBDC will have a significant impact on the monetary transmission mechanism, which in turn will affect monetary policy. In short, the CBDC scenario could allow the central bank to have more control over the overall financial conditions of the economy and hence aggregate demand.

The Duty of the Central Banks of the New World

Central banks, as key actors of the monetary system, are in a constant struggle to realize their vision of making this system versatile and robust. This effort has become even more important due to these rapid developments in the financial system. These efforts are necessary to make adjustments that anticipate future developments rather than simply reacting to the past. Therefore, central banks should be vigilant and follow the market dynamics more closely and make the necessary regulations and developments very quickly. Otherwise, they will lag behind the market and the digital world and will not be able to effectively carry out monetary policy management, which is their main duty. This will bring along a situation that will have devastating effects on the entire macroeconomic system, especially the financial markets.

- Auer, R, G Cornelli and J Frost (2020): “Rise of the central bank digital currencies: drivers, approaches and technologies”, BIS Working Papers, no 880, August.

- Bank of England (2022): Responses to the Bank of England’s Discussion Paper on new forms of digital money, March.

- Basel Committee on Banking Supervision (BCBS) (2021): Prudential treatment of crypto assets exposures, consultative document, June.

- Board of Governors of the Federal Reserve System (2022): “Money and payments: The U.S. dollar in the age of digital transformation”, January.

- BIS Annual Economic Report, June 2022