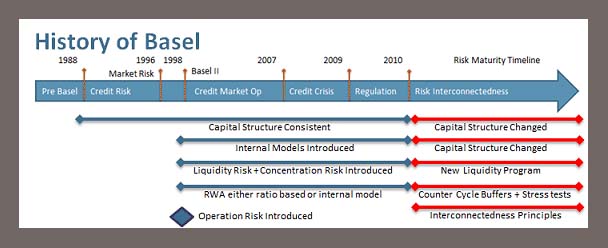

In recent history, economic crises have been experienced many times. Almost all of the crises either originated from financial markets or emerged in a way that significantly affected the financial markets. In almost all economic crises small or large banks are bankrupted in the end. Understanding the importance of the banking sector in the general economy, the Basel Committee on Banking Supervision (BCBS) of the Bank for International Settlements (BIS), of which the 63 central banks are members, was established to protect banks against crises. Basel represents a system for the international coordination of national banking regulation. BCBS aims to ensure that banks are vigilant and strong against possible risks and crises by bringing standards for banking. For these purposes, BCBS has published Basel I, Basel II, and Basel III Criteria in order to achieve safety and soundness in banking.

Basel III Regulations

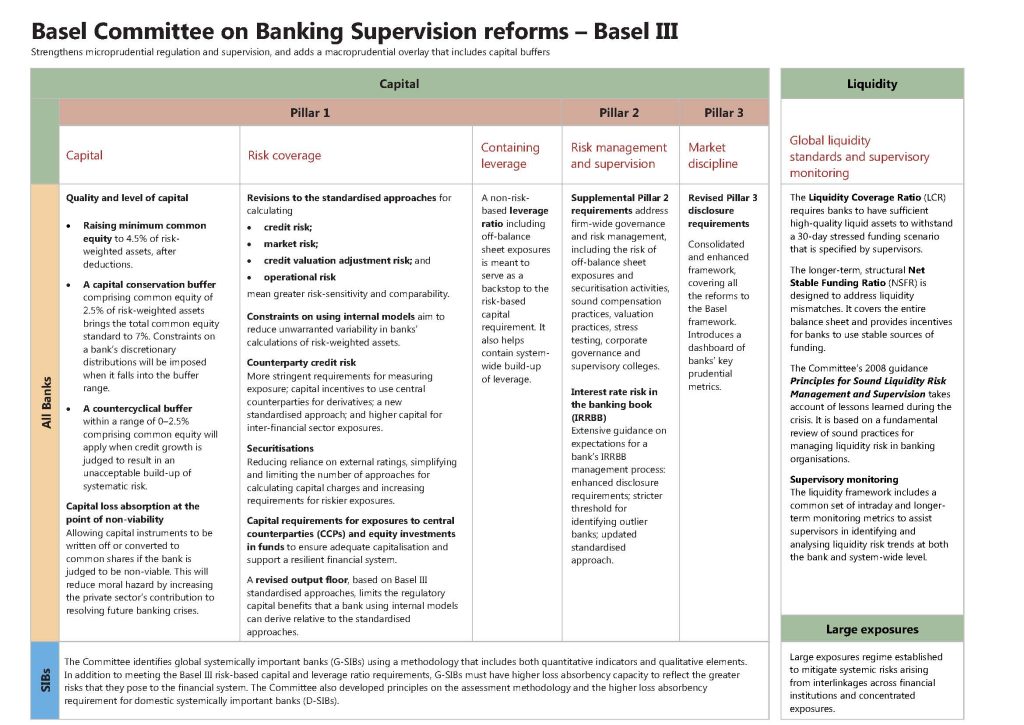

Since banks are the leading actors in the emergence of this crisis, deficiencies in regulation and supervision in the banking sector were frequently criticized after the 2008 Global Crisis. During the crisis, and indeed in the pre-crisis period, the Basel II Criteria, which provide regulations in the field of banking, were in force. During this period, Basel II Criteria were strongly criticized due to the financial crisis and its effect on banks. For this reason, discussions began concerning the necessity of new regulations. Thus, reading the 2008 global crisis well, the Basel III Criteria were issued in 2010 in order to prevent crises and strengthen the banking system. The new Basel Criteria a progression of the Basel II Accord aims to eliminate the deficiencies of the predecessor and brought some innovations. This new accord, with its innovations regarding the quality and quantity of capital, also includes regulations on liquidity, changes in the calculation of counterparty risk, set new rules on banking, and efforts to increase supervisory efficiency.

Basic Principles of Basel III Criteria

More Qualified Capital: Capital is the most important item for banks to operate. The reason for this is the use of own capital against possible crises and the opportunity to meet risk in risk assessments. The amount of capital is crucial for a Bank. This amount is particularly important in times of crisis. Banks are trying to obtain the highest return on equity by operating with the lowest possible capital amount. However, operating with very low or insufficient capital and liquidity puts banks in a process that can go to bankruptcy in the case of possible losses arising from credit defaults and other investments. As a result, implementing standards regarding the adequacy of capital and liquidity would be beneficial. In addition to the amount of capital, the issue of quality came into force with a new regulation. As a result of the studies on the quality of capital, a new item called Loss Compensation Capital was created. With this new capital, it is aimed to provide stronger and more resilient banking during crises.

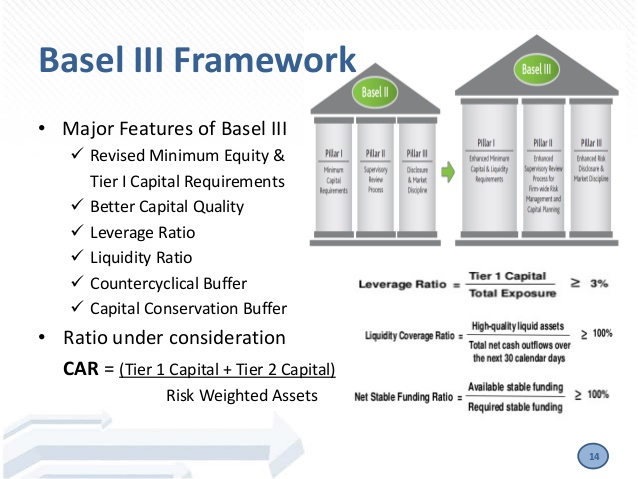

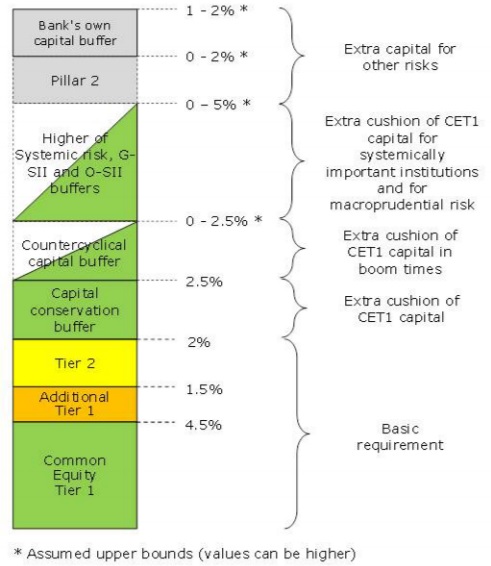

Quantified Capital: Along with the Basel III Criteria, the amount of capital has also been increased. With the new regulation, core capital and main capital ratios were increased. Accordingly, the core capital ratio increased to 7% and the Tier 1 capital ratio to 10.5%. These ratios were 4.5% and 8% respectively in Basel II.

Establishment of Capital Buffers: 2 new capital buffers were defined for the first time with Basel III regulations.

The capital protection buffer introduced by Basel III gradually added to core capital, main capital, and total capital.

The cyclical capital buffer which varies between 0% and 2.5% depending on the country’s conditions and preferences has been created. This buffer should be separated from core capital or other capital components which are fully capable of absorbing losses.

Leverage Ratio: A transparent, simple, understandable, and non-risk-based leverage ratio, which supports capital ratios, has been introduced. This ratio is calculated by dividing the main capital by the total of off-balance sheet items and assets are taken into account with certain conversion rates.

Liquidity Ratios: With Basel III, two ratios, namely Liquidity Coverage Ratio and Net Stable Funding Ratio, were established.

The Liquidity Coverage Ratio, calculated by dividing the bank’s liquid assets by the net cash outflows that will occur within 30 days, must be at least 100%. Net cash outflow is the difference between cash outflows within 30 days and cash inflows within 30 days.

Net Stable Funding Ratio was established in order to provide more stable and reliable funding by strengthening the liability structures of banks in the medium and long term. This ratio is calculated by dividing the “available stable funding amount” by the “needed stable funding amount”. Similar to the liquidity coverage ratio, it must be at least 100%.

The European Side: CRR and CRD IV

To encourage capital regulations in line with the Basel III criteria, the European Parliament and the European Council adopted CRR and CRD IV on 26 June 2013, which implement Basel capital standards in the EU. The EU’s new framework for bank capital requirements came into force on 1 January 2014. CRD IV commonly refers to both:

Based on the mandate of the European Commission, the European Banking Authority has published an impact assessment and recommendations for the transposition of the final Basel III framework into EU law. The limitations and conditions in Basel III and the calculations related to them have basically been made mandatory in all member states with separate regulations issued by the European Commission. CRR and CRD IV, which include these regulations, are the most basic binding elements for member states. The CRR is a directly applicable Regulation for banks and their supervisors in the EU, across all member states applying Basel III standards in the European Union. In contrast, CRD IV is a directive that requires member states to enact legislation that complies with the requirements of this directive. Failure to enforce national legislation also requires immediate punishment through a violation procedure. In other words, while regulatory capital and other prudential requirements are contained in the CRR, member states’ auditors are not given specific powers, such as imposing specific capital requirements for risks not covered by the CRR’s capital requirements.

The purpose of CRD IV is to effectively implement Basel III capital requirements, including at the level and form that capital should be maintained. As such, banks will need to meet Tier 1 capital requirements (going-concern capital), defined as equity plus all non-debt, long-term securities, at least 6% of risk-weighted assets (RWA). The highest form of Tier 1 capital is Common Equity Tier 1 (CET 1) capital, which had to be at least 4.5% by 2015. Tier 2 capital (gone-concern capital) is designed to ensure the repayment of depositors and senior creditors in the event of bankruptcy. To meet the Basel Tier 2 standard and CRD IV requirements, banks must have a minimum 8% ratio of total capital/RWAs. The CRD IV regulations tighten the definition of common equity, simplify the definition of what amounts to Tier 2 capital, and remove the use of a Tier 3 capital standard. In line with Basel III, the CRD IV proposals create five new capital buffers:

- the Capital Conservation Buffer,

- the Counter-Cyclical Buffer,

- the Systemic Risk Buffer,

- the Global Systemic Institutions Buffer and

- the Other Systemic Institutions Buffer.

The CRR introduces two new liquidity buffers:

- the Liquidity Coverage Requirement is intended to improve the short-term resilience of the liquidity risk profile of firms and

- the Net Stable Funding Requirement is intended to ensure that a firm has an acceptable amount of stable funding to support its assets and activities over the medium term.

The leverage ratio in CRD IV is defined as Tier 1 capital divided by a measure of non-risk-weighted assets. While the CRR regulations specified the need for a leverage ratio, they did not specify at what level this ratio should be adjusted. It has been stated that a decision will be made after a set of numerical studies is carried out in the coming years.

Although CRD IV represents the implementation of Basel III capital accords, CRD IV does not conform 100% to Basel III. Because, some additional obligations or changes were made in the CRR and CRD regulations, different from the regulations in Basel III. There are differences from the minimum requirements set in the Basel framework, particularly in the definition of the capital component, in the treatment of investments in capital instruments of insurance company subsidiaries. Additionally, there are some differences in credit risk components that are more liberal than those envisaged in Basel standards.

While the Basel capital adequacy agreements apply to “internationally active banks,” it has always applied to all banks as well as investment firms in the EU. This wide scope is necessary for the EU where banks authorized in one Member State can provide their services across the EU’s single market and, as such, are more than likely to engage in cross-border business on a level playing field. Member States are effectively being given only six months to transpose the Directive and to change any national laws impeding the proper application of the Regulation.

CRD IV introduced new rules on auditing, corporate governance, remuneration, sanctions, counterparty credit risk for derivatives, and reliance on credit ratings as well as capital requirements, leverage ratios, and buffers. The corporate governance provisions in CRR and CRD IV show the efforts to reduce the excessive risk accumulation experienced in the 2008 crisis in the global financial system.

CRD IV regulations also aim to strengthen the requirements regarding corporate governance regulations and processes. It aims to improve the status of the risk management function and to ensure that the risks are monitored effectively by the auditors. It is also aimed to increase the diversity in the boards of directors, provide a wider range of views, and thus create effective risk management. Criticism issues that emerged with the 2008 crisis, such as remuneration rules and bonus ceiling, were also included in CRD IV. For example, according to these new rules, the variable component (bonus) of the compensation is limited to 100% of the fixed fee component for managers of key risk areas.

It is also possible to increase this ratio under certain conditions. Additional transparency and disclosure requirements have also been introduced for certain individuals earning more than 1 million Euros per year. These restrictive regulations apply only to personnel who have a significant impact on the risk profile of the relevant organization due to their position. This includes senior management, risk takers, controllers, and all employees who receive total wages that include them in the same compensation group as senior management and risk takers.

What is Next?

The new Basel standards, also called Basel IV, are amendments to the international standards for bank capital requirements adopted by BCBS in 2017, which should be implemented in January 2023. These reforms revise the standardized approach for credit risk (SA-CR), the internal ratings-based approach for credit risk (IRB), the credit valuation adjustment (CVA) framework, the calculation of operational risk RWAs, the leverage ratio, and introduce an aggregate output floor for risk-weighted assets (RWAs).

The BCBS press release summarized the reforms as follows:

- a revised standardized approach for credit risk, which will improve the robustness and risk sensitivity of the existing approach;

- revisions to the internal ratings-based approach for credit risk, where the use of the most advanced internally modeled approaches for low-default portfolios will be limited;

- revisions to the credit valuation adjustment (CVA) framework, including the removal of the internally modeled approach and the introduction of a revised standardized approach;

- a revised standardized approach for operational risk, which will replace the existing standardized approaches and the advanced measurement approaches;

- revisions to the measurement of the leverage ratio and a leverage ratio buffer for global systemically important banks (G-SIBs), which will take the form of a Tier 1 capital buffer set at 50% of a G-SIB’s risk-weighted capital buffer; and

- an aggregate output floor, which will ensure that banks’ risk-weighted assets (RWAs) generated by internal models are no lower than 72.5% of RWAs as calculated by the Basel III framework’s standardized approaches. Banks will also be required to disclose their RWAs based on these standardized approaches.

These reforms will take effect from 1 January 2023, except for those that will be implemented gradually until 1 January 2028.

On the other hand, the European Commission has published a comprehensive set of amendments to the EU Capital Requirements Regulation, the Capital Requirements Directive, and the Bank Rescue and Resolution Directive for the new Basel rules mentioned above. These are now called CRD6/CRR3 and primarily include the BCBS December 2017 consensus above on the completion of the Basel 3 bank capital framework. The Commission sets 1 January 2025 as the implementation date for most articles of CRR3 (covering the majority of the Basel 3.1 framework) (CRR Art. 2). This is two years later than the BCBS’s 1 January 2023 deadline.

In EC regulations, the phase-in period for the Standardized Output Base is pushed back two years so that the fully loaded framework will not come into effect until 1 January 2030 at the earliest, whereas the BCBS timeline will continue until 2028. In addition, CRD6/ CRR3 negotiations are expected to continue within this period, January 2025 is the earliest applicable implementation date for now. However, some member states may press for the fully loaded Output Floor of the BCBS to be implemented at a later date.

The Commission was under significant pressure to limit the expected large capitalization impact of the so-called Basel 4 implementation on EU banks, and as a result, it proposed a series of changes in the BCBS framework to mitigate capital increases. Therefore This means that CRD6/CRR3 is a proposal that implements the Basel framework with a number of important changes. The net effect of these changes is an average increase of 6.4 in minimum capital requirements for EU banks, according to the Commission’s own assessment. Before CRD6/CRR3 becomes law, it is expected to be open to a long political discussion. In terms of timing, the CRD6/CRR3 negotiations are likely to take a similar amount of time, given that previous CRD/CRR negotiations took more than two years to complete. As a result, a political agreement on a final law is not expected before the end of 2023 at the earliest. For this reason, it is thought that important changes can still be made in Basel 4 practices by the European Parliament or the European Council as part of this process.

https://ec.europa.eu/commission/presscorner/detail/en/MEMO_13_272

www.esrb.europa.eu/national_policy/ccb/html/index.en.html

https://www.bis.org/press/p171207.htm

https://www.bis.org/bcbs/history.htm

https://www.bis.org/bcbs/basel3.htm

https://www.eba.europa.eu/regulation-and-policy/implementing-basel-iii-europe