How much equity does a bank need to run its business against its risks? The Basel Committee on Banking Supervision (BCBS) has been trying to find an answer to this question for decades. With the Basel framework, it publishes rules that change the long-term equity requirements for the banking sector. The aim is to strengthen the stability and resilience of banks.

In our previous article, (https://economyandfinanceforum.com/2022/08/02/banking-regulations-basel-iii-crd-iv/) we mentioned the regulations called Basel about the capital adequacy to be held against the risks in banks. Now, we will try to explain these risks and the regulations in detail. Our first article on this subject will be about operational risk.

As we mentioned in our previous Artikel, deficiencies in regulation and supervision in the banking sector were frequently criticized after the 2008 Global Crisis. During the crisis, it became clear that many credit institutions did not have sufficient equity and enough liquidity to cover the risks associated with lending and other banking operations. Many banks would go bankrupt if they were not bailed out with governmental aid.

WHAT IS OPERATIONAL RISK?

Operational risk, in its broadest definition; is the risk that cannot be associated with directly measurable risks such as credit, market, and currency risks. By the Basel Committee, operational risk is perceived as a risk inherent in all banking products, services, and transactions. Operational risk is defined by the Basel Committee as “the risk of direct or indirect loss arising from inadequate and unsuccessful internal processes, personnel, and systems, or external events”.

Operational risk can be caused by internal or external factors. Internal factors are considered to be internal issues such as the inadequacies of the banks’ services, the faults of their systems, faulty operations, the abuses of the personnel, and faulty accounting transactions. External factors in contradiction are considered to be many situations such as illegal attacks, natural disasters, legal changes, and changing practices of regulatory authorities. In this respect, operational risk actually is the risk that the system in the hands of the bank will fail as a result of fraudulent activities, natural disasters, human-induced errors or omissions, the wideness of the system network, the development of electronic commerce day by day, major mergers and acquisitions and expansions in the activities of banks.

MEASURING THE OPERATIONAL RISK: BASEL APPROACH

In order to prevent Banks from internal and operational risks, BCBC struggles over the years to find a proper way of calculating of the risks and corresponding capital to preserve in accordance with the size of banks, risks, and impacts. For this reason, the measurement of the risks by the Basel committee varied over the years, parallel with the change in the type and severity of risks and their impacts

Basel II & III approach

The basic indicator approach, standard approach, or advanced approach (Advanced Measurement Approach, AMA) is currently used for capital support for operational risk. While smaller institutions often use simpler approaches such as the basic indicator approach and the standardized approach (which are based on income statement data) the advanced Measurement Approach taps into the complex modeling of capital support required for operational transactions.

The Basel Committee recommends four approaches to calculating the minimum capital required for banks’ operational risk.

Basic Indicator Approach: The Basic Indicator Approach is the simplest approach that can be used in operational risk measurement. It is a fairly simple method and requires the capital to be allocated for operational risk to be calculated to a certain ratio of a fixed indicator.

Standard Approach: In the Standard Method, bank operations are divided into eight main business lines and capital requirement is calculated for each business line. In this method, the gross income obtained from each business line is multiplied by the coefficient determined for the business line.

Alternative Standard Approach: In the Alternative Standard Approach, the amount of operational risk regulatory capital is the same as the standard approach, except for the two business lines (retail banking and commercial banking). In the Alternative Standard Approach, 3.5% of the total receivables related to these activity lines in assets are used instead of gross income for retail banking and corporate banking business lines, or 3% of the total receivables related to these business lines in assets for retail banking and corporate banking business lines.

Advanced Measurement Approaches: Advanced Measurement Approaches include the most risk-sensitive methods, and the bank’s internal risk measurement system and associated loss data are used in calculating the capital requirement based on these methods. With these approaches, banks will have the opportunity to allocate lower capital compared to basic indicators and standardized approaches.

Basel IV: New standardized approach

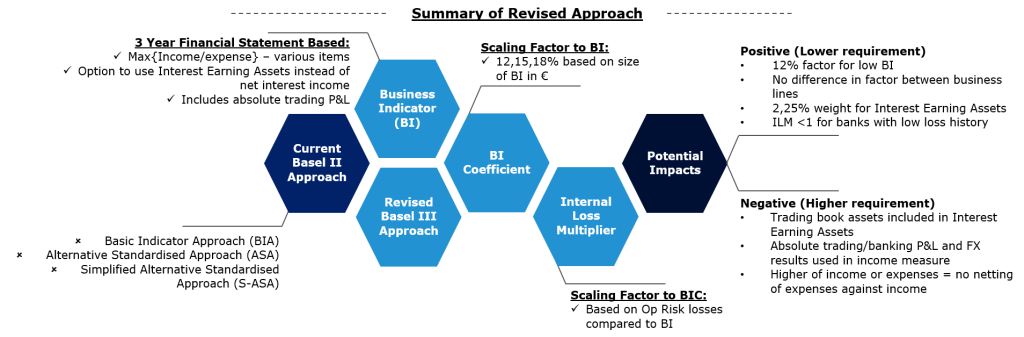

Existing approaches have some weaknesses such as lack of risk sensitivity and lack of comparability. To simplify the calculation of capital requirements for operational risk, the BCBS will replace all existing approaches with a single non-model-based approach. This approach is known as the “new standardized approach”. The new approach is built upon the well-known basic indicator approach and the standard approach.

Within Basel IV, both the business indicator component (BIC) and the loss component (internal loss multiplier, ILM) are included in the calculation of capital requirements for operational risk.

The business indicator component (BIC)

The business indicator component is calculated as the business indicator multiplied by a specific, size-dependent percentage. Certain data from the profit and loss accounts of the last three years are used to calculate the business indicator of each bank.

The BIC corresponds to a progressive measure of income that increases with a bank’s size. It serves as the baseline capital requirement and is calculated by multiplying the Business Indicator (BI) by marginal coefficients. The BI is a financial statement-based proxy for operational risk consisting of three elements, each calculated as the average over three years:

- the interest, leases, and dividend component;

- the services component; and

- the financial component.

Marginal coefficients are regulatory determined constants based on the size of the BI.

Banks with a BI greater than 1 billion EURO are required to use loss data as a direct input into the operational risk capital calculations. The soundness of data collection and the quality and integrity of the data are crucial to generating capital outcomes aligned with the bank’s operational loss exposure. Banks that do not meet the loss data standards are required to hold capital that is at a minimum equal to 100% of the BIC.

The internal loss multiplier (ILM)

The ILM is a risk-sensitive component capturing a bank’s internal operational losses. It serves as a scaling factor that adjusts the baseline capital requirement depending on the operational loss experience of the bank. It is proportional to the ratio of the loss component (LC) and the BIC, whereby the LC corresponds to 15 times the average annual operational risk losses incurred over the previous 10 years. In calculating the LC, banks need to meet the requirements on loss data identification, collection, and treatment.

With the new approach to operational risk calculation, traceability and comparability among banks will become easier. However, a prerequisite for the successful implementation of the new requirements – in addition to good data quality – is the possible adjustment of data deliveries and reporting processes. Up to now, collecting and maintaining loss data is made by most banks but it will still be important that the data is complete and up-to-date in this process.

The minimum threshold for including a loss event in the data collection and calculation of average annual losses is set at 20,000 EURO. At national discretion, for the purpose of the calculation of average annual losses, supervisors may increase the threshold to 100,000 EURO for banks.

EUROPEAN SIDE: CRD IV

The first elements of Basel III standards have been implemented in European jurisdiction through the Capital Requirements Regulation (CRR) No 575/2013 and the Capital Requirements Directive 2013/36/EU (CRD).

According to Article 4 (52) of the Capital Requirements Regulation (CRR), “operational risk” means the risk of loss resulting from inadequate or failed internal processes, people, and systems or from external events, and includes legal risk.

The CRR envisages three alternative methods for calculating the own fund’s requirements for operational risk:

- Basic Indicator Approach (BIA) – Article 315 f. CRR

- Standardized Approach (STA)/Alternative Standardized Approach (ASA) – Article 317 ff. CRR

- Advanced Measurement Approaches (AMA) – Article 321 ff. CRR

The calculation basis for the Basic Indicator Approach and the Standardized Approach is the three-year average of the “relevant indicator”, which is calculated from certain items in the profit and loss account (net interest and net commissions received, the trading result, and other operating income). When using the Basic Indicator Approach, multiplying the “relevant indicator” by a fixed factor of 15% produces the own fund’s requirements.

On the other hand, the specification and adaptation of the selected requirements are ongoing. On 27 October 2021, the European Commission published the draft CRR III and CRD VI. The final key element of the Basel III reforms (BCBS 424), also known as Basel IV, will be implemented in the European area starting from 1 January 2025.

CRR III focuses on innovation within the framework of Basel standards in setting capital requirements. This affects credit risk and operational risk, credit valuation adjustment risk (Credit Valuation Adjustment Risk, CVA), and a lower capital limit called the output floor. The fundamentally more standardized approaches introduced with Basel IV are a plus in terms of simplification and comparability. However, migrating to new approaches and, if necessary, linking new regulations with the real situation is always an additional cost for banks and will affect pricing in addition to the expected additional capital requirements.

Within Basel IV, both the business indicator component (BIC) and the loss component (internal loss multiplier, ILM) are included in the calculation of capital requirements for operational risk. To ensure a level playing field within the EU and to simplify the calculation of the capital requirement for operational risk, the European Commission has decided to ignore the loss component for all institutions in the EU.

The European Union has made some changes to the thresholds that are defined in the Basel documents. According to this, institutions with a business indicator (BI) of at least 750 million Euros are required to maintain their annual losses due to operational risk. When calculating the business indicator, loss events above a threshold exceeding €20,000 are taken into account. Events that exceed the € 100,000 threshold will also be subject to a disclosure requirement. For institutions with a commercial indicator of up to 1 billion Euros and an unreasonably high burden, the competent authorities may issue exceptions to the protection of lost data.

Banks are advised to assess the new regulations and initiate appropriate analyzes and projects to comply with the new standard approach that will have effects on the level of capital requirements and ultimately on regulatory capital ratios.